Fintech Regulations: What You Need to Know About Protecting Your Investments

When you invest through apps like SoFi, Betterment, or Wealthfront, you're trusting your money to fintech regulations, the legal rules that force financial tech companies to keep your money separate from their own and prove they’re not misusing it. Also known as digital finance compliance, these rules exist because without them, your savings could vanish if a platform goes under—just like what happened with some crypto exchanges in 2022. This isn’t theoretical. In the UK, firms must follow CASS 7, a strict rule requiring daily reconciliation of client funds and full segregation from company assets. In Australia, ASIC Client Money, the set of rules that govern how brokers hold customer cash and securities does the same thing. These aren’t suggestions—they’re legal requirements backed by audits and penalties.

Fintech regulations don’t just cover how money is stored. They also control how firms handle your data, disclose fees, and manage conflicts of interest. For example, if a robo-advisor pushes you into a fund because it earns them a kickback, that’s a violation. That’s why tax-loss harvesting, a strategy that sells losing investments to cut your tax bill is only allowed if the platform clearly explains how it works and doesn’t manipulate trades for profit. The same goes for client money rules, the backbone of investor protection that stops firms from using your cash to fund their operations. When a company fails to reconcile daily or skips audits, it’s not just sloppy—it’s illegal. And that’s why posts on this page dig into real cases where firms got caught, how automation is making compliance easier, and what you should ask your platform before you deposit a dime.

You don’t need to be a lawyer to understand this stuff. But you do need to know what protections exist—and what gaps still linger. The articles below break down how these rules actually work in practice: who enforces them, where they fall short, and how to spot a platform that’s cutting corners. Whether you’re using a robo-advisor, trading crypto, or just keeping cash in a digital account, these rules are the invisible safety net keeping your money safe. And if you don’t know what’s in place, you’re flying blind.

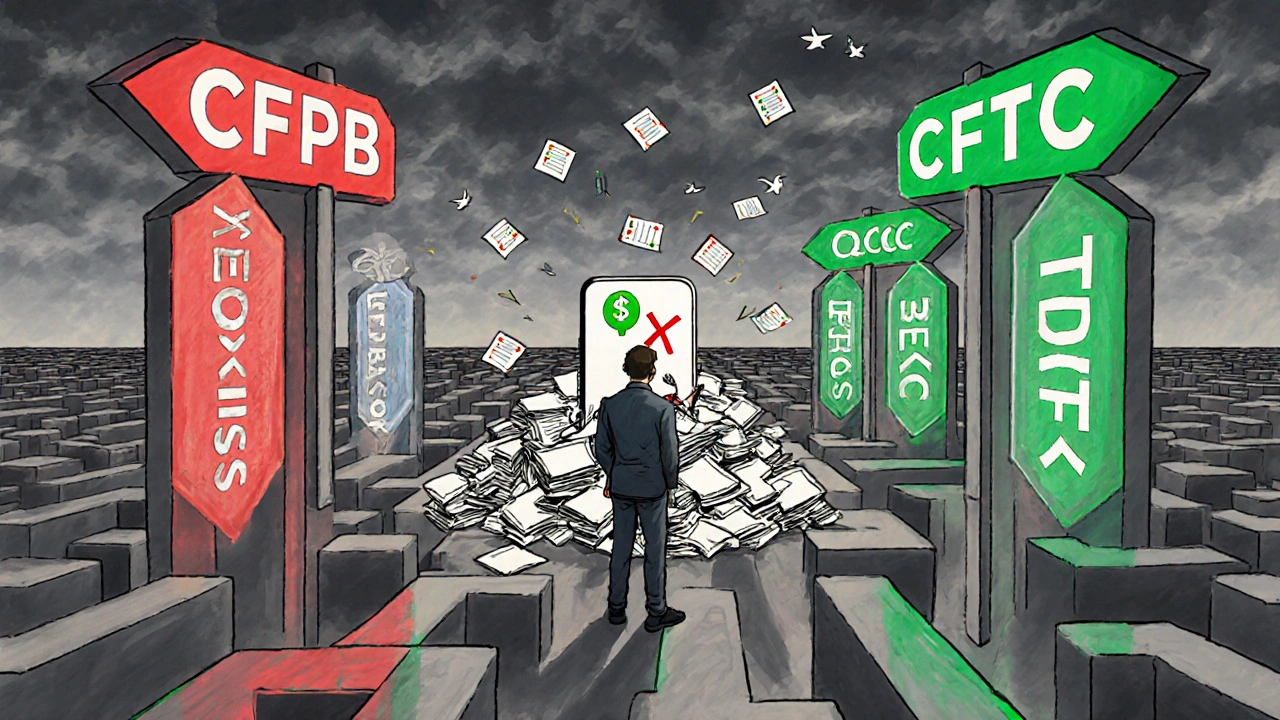

Fintech Regulations: Global Overview and Compliance in 2025

Fintech regulations in 2025 are fragmented, complex, and rapidly evolving. From the EU's MiCA to the U.S. CFPB's Section 1033, compliance is no longer optional-it's a core part of product development. This guide breaks down global rules, costs, and strategies to stay ahead.

View More