Fintech Compliance: What It Really Means for Your Investments

When you invest through a robo-advisor or digital broker, fintech compliance, the set of legal and operational rules that force financial tech companies to protect your money. Also known as financial regulation for digital platforms, it's the invisible safety net that stops your funds from vanishing if the company goes under. This isn’t theory—it’s the reason your money stays safe even when platforms like SoFi or Betterment automate your investments.

Fintech compliance isn’t one rule—it’s a stack of them. The most important? client money rules, laws that require firms to keep your money separate from their own. If a company goes bankrupt, your cash shouldn’t be used to pay its bills. In the UK, that’s CASS 7, a detailed framework under the Financial Conduct Authority that demands daily reconciliation and strict segregation. In Australia, it’s ASIC Client Money, rules that force brokers to track every dollar you deposit and prove it’s not mixed with company funds. Without these, your emergency fund sitting in a digital account could disappear overnight.

And it’s not just about keeping money separate. reconciliation, the daily process of matching client balances with actual bank records. If a firm can’t prove their books match reality every single day, they’re breaking the law. That’s why automated reconciliation tools are now standard in compliant platforms—manual checks are too slow, too error-prone. Firms that skip this? They get fined. Or shut down. And you? You lose access to your money.

These rules exist because people have lost everything. Remember when a fintech startup collapsed and clients couldn’t touch their funds? That’s why compliance isn’t boring—it’s life insurance for your investments. The platforms you trust are built on these systems. You don’t need to audit them yourself, but you should know what to look for: daily statements, clear segregation language, and transparency about which regulator oversees them.

What you’ll find below isn’t a list of regulations—it’s a collection of real stories, breakdowns, and comparisons from actual platforms. You’ll see how ESG robo-advisors handle compliance differently than crypto brokers. How tax-loss harvesting tools are built to meet audit standards. Why bond ladders are easier to track under client money rules than volatile crypto holdings. These posts don’t just explain compliance—they show you how it protects your portfolio, day after day.

Fintech Regulations: Global Overview and Compliance in 2025

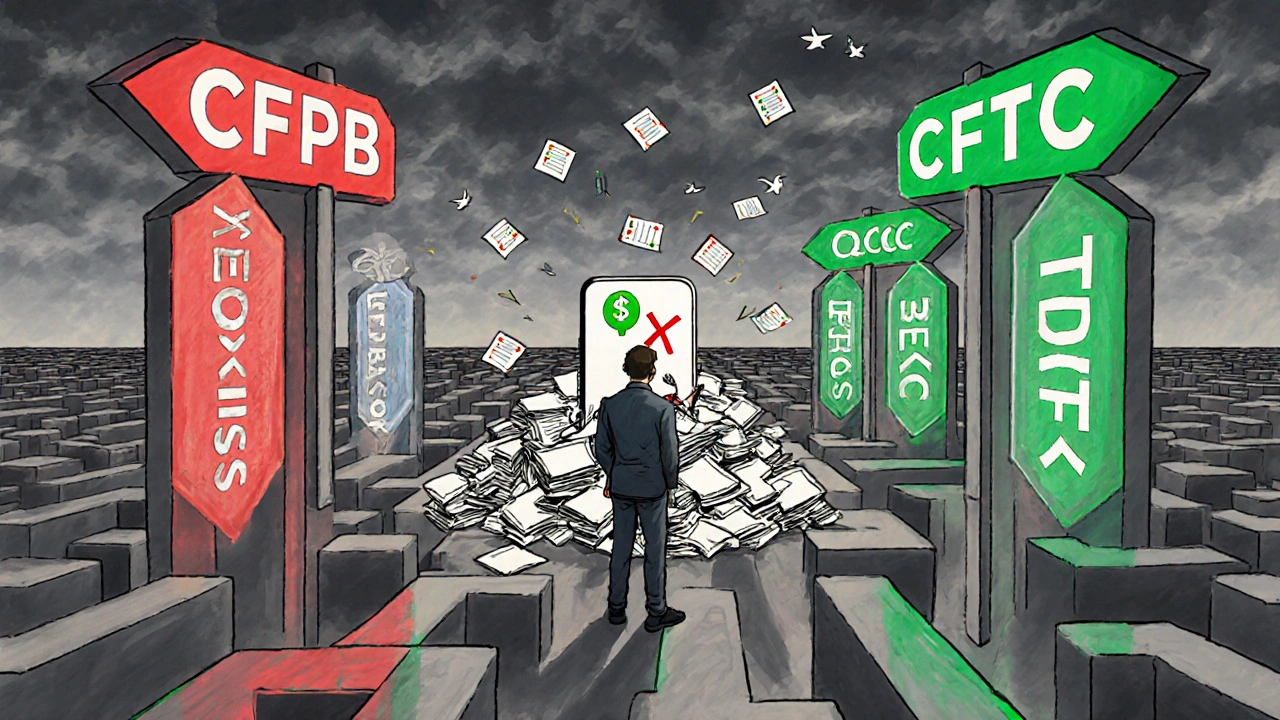

Fintech regulations in 2025 are fragmented, complex, and rapidly evolving. From the EU's MiCA to the U.S. CFPB's Section 1033, compliance is no longer optional-it's a core part of product development. This guide breaks down global rules, costs, and strategies to stay ahead.

View More