Emergency Savings Target: How Much You Really Need to Stay Safe

When we talk about an emergency savings target, the specific amount of cash you aim to keep on hand to cover unexpected expenses without going into debt. Also known as an emergency fund, it’s not a suggestion—it’s your financial seatbelt. Most people hear "save 3 to 6 months of expenses" and freeze. But that number? It’s a starting point, not a rule. Your real emergency savings target depends on your income stability, monthly bills, dependents, and how fast you could bounce back if things went sideways.

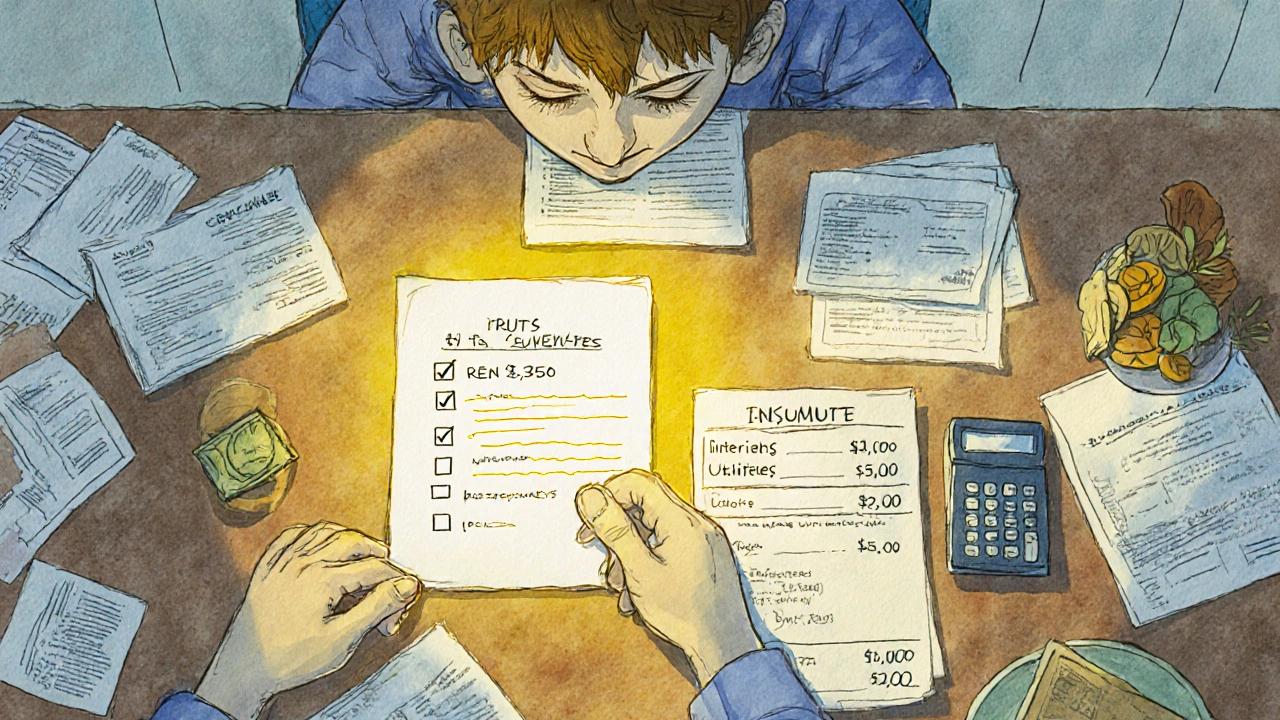

Think about your cash reserve, liquid money you can access immediately without penalties or delays. It’s not in a CD, not in a brokerage account—it’s in a high-yield savings account, easy to pull from when your car breaks down, your dog needs emergency surgery, or your freelance gig disappears. This isn’t about being rich. It’s about not being terrified. If you’re the sole income earner, have unpredictable work, or live paycheck to paycheck, your target should be higher than the textbook number. One woman we spoke to kept 8 months saved after her husband lost his job during the pandemic. She didn’t panic. She just paid bills. And if you’re single, working remotely, and have no kids? Maybe 3 months is enough. But don’t just copy someone else’s number. Look at your own life. What’s the worst-case scenario you can imagine? How long could you last without income? That’s your real target.

Your financial safety net, the buffer between you and financial stress during unexpected disruptions. It’s not magic. It’s math. Track your essential expenses—rent, groceries, insurance, utilities, transportation—for three months. Add them up. Divide by three. That’s your monthly baseline. Multiply that by the number of months you feel safe with. No more, no less. And if you’re not sure? Start with one month. Then two. Then three. Progress beats perfection. The posts below don’t just tell you how much to save. They show you how to build it slowly, keep it safe, and use it wisely when you really need it. You’ll see real stories from women who hit their targets, what went wrong, and how they got back on track. No fluff. No guesswork. Just what works.

How Much Should You Save in Emergency Fund? Step-by-Step Calculation Method

Stop using generic advice. Learn the exact step-by-step method to calculate your emergency fund based on your real expenses, income stability, and risks. Get your personalized savings target now.

View More