Emergency Fund Guide: How Much You Really Need and Where to Keep It

When life throws a curveball—a broken car, a sudden medical bill, or a job loss—your emergency fund, a dedicated stash of cash meant for unexpected expenses, not future vacations or impulse buys. Also known as emergency savings, it’s the financial buffer that keeps you from going into debt when things go sideways. This isn’t about being paranoid. It’s about being in control. And if you’re a tech-savvy woman managing investments, crypto, or robo-advisors, you already know that markets don’t care about your calendar. But cash? Cash doesn’t crash.

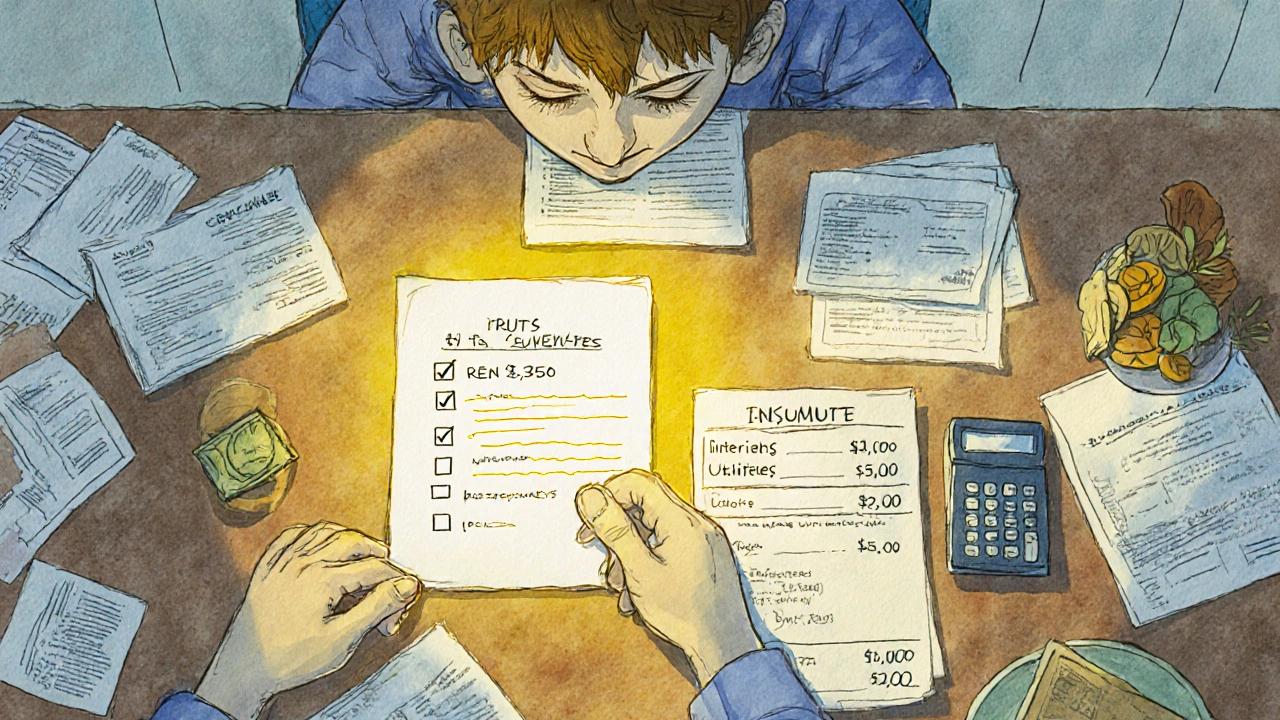

Most people hear "three to six months of expenses" and panic. But here’s the truth: that number isn’t magic. It’s a starting point. If you work freelance, have kids, or live in a city where a flat tire costs $800, you might need more. If you’re on a stable salary with good benefits and zero debt, maybe three months is enough. The real question isn’t how much you should save—it’s how much you can lose before you’re in real trouble. Look at your monthly bills: rent, groceries, insurance, phone, internet. That’s your baseline. Now add in the stuff you can’t skip—like car repairs or prescriptions. That’s your number. And don’t wait for the "perfect" amount. Start with $500. Then $1,000. Then build from there. Your cash as asset, a strategic holding that gives you flexibility during market downturns isn’t just for emergencies. It’s your leverage. Top investors keep dry powder—not because they’re scared, but because they know crashes don’t come with warning signs. Having cash ready lets you buy when others are selling.

Where you keep it matters just as much as how much you save. A regular savings account? Fine. A high-yield savings account? Better. A money market fund? Even better. But never—never—put it in stocks, crypto, or bonds. That’s not an emergency fund. That’s a gamble. Your fund needs to be instant, safe, and accessible. Think: one click, no penalties, no waiting. And if you’re using apps like SoFi or Chime, make sure your emergency cash lives in a separate account. Not hidden in your checking. Not mixed with your investing money. Separate. Simple. Clear.

You’ll find posts here that dig into the psychology behind why people hold onto losing investments instead of using their cash wisely. You’ll see how behavioral biases like hope bias and sunk cost fallacy keep people stuck. You’ll learn how top investors use dry powder to buy during crashes—and why holding cash isn’t lazy, it’s smart. You’ll even see how automated tools and robo-advisors handle liquidity, and why most don’t touch your emergency fund. This isn’t about theory. It’s about what actually works when your car dies at 2 a.m. and your credit card is maxed out. These guides give you the real numbers, the real tools, and the real mindset to build an emergency fund that doesn’t just sit there—it protects you, empowers you, and gives you peace of mind while you grow your wealth.

How Much Should You Save in Emergency Fund? Step-by-Step Calculation Method

Stop using generic advice. Learn the exact step-by-step method to calculate your emergency fund based on your real expenses, income stability, and risks. Get your personalized savings target now.

View More