Emergency Fund Formula: How Much You Really Need and Where to Keep It

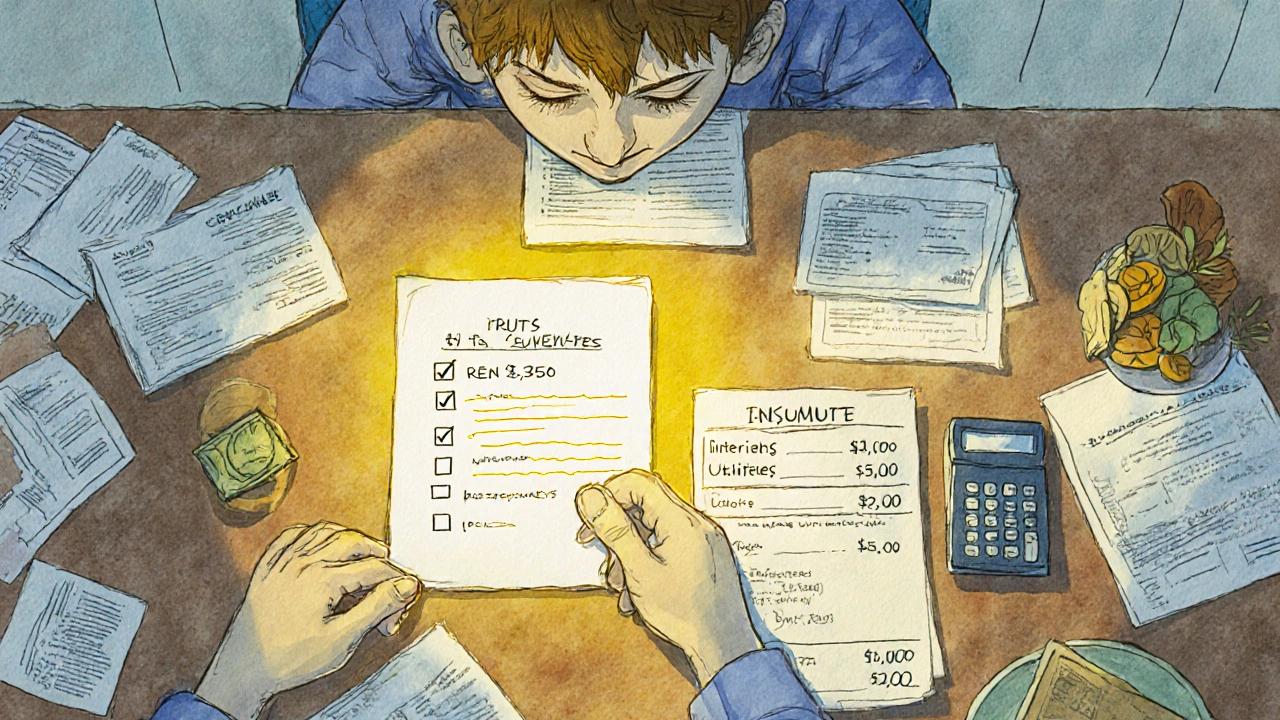

When we talk about an emergency fund, a dedicated stash of cash set aside for unexpected expenses like medical bills, car repairs, or job loss. Also known as a financial safety net, it's not about being paranoid—it's about having control when life goes off-script. Most people hear "save 3 to 6 months of expenses" and zone out. But that number? It’s a starting point, not a rule. Your real emergency fund formula depends on your income stability, your dependents, your access to credit, and whether you live in a place where medical bills can wipe you out overnight.

Think of your emergency fund as the anchor in a storm. You don’t need a giant one if you’re single, have a stable job, and can tap into a low-interest line of credit. But if you’re self-employed, the sole provider, or work in a volatile industry, you might need 8 or even 12 months. That’s not a suggestion—it’s a survival tactic. And here’s the thing most guides skip: dry powder, cash held strategically to seize opportunities during downturns isn’t just for hedge funds. It’s your personal version of the same idea. Keeping cash ready isn’t wasting money—it’s buying yourself time, peace, and options. That’s why your emergency fund should live in a high-yield savings account, not a checking account or, worse, under your mattress. You want it accessible, safe, and earning something, even if it’s just 4%.

Related to this is the concept of cash as asset, treating cash not as idle money but as a strategic tool with real value. In volatile markets, holding cash isn’t cowardly—it’s smart. It lets you avoid panic selling, cover unexpected costs without touching investments, and even buy dips when others are forced to sell. Your emergency fund is the first layer of this strategy. The second? Knowing when to use it. Don’t touch it for a new phone or a vacation. Save that for your fun money account. This fund is only for real emergencies—ones that threaten your financial stability.

What you’ll find below isn’t theory. It’s real advice from people who’ve been laid off, had cars break down, or faced medical surprises—and figured out what actually worked. We’ve pulled together guides on how much to save based on your job type, where to put your money so it doesn’t lose value, and why most people overestimate what they need (and underestimate what they can handle). You’ll see how the emergency fund formula changes for freelancers, moms returning to work, and tech workers in shrinking industries. No fluff. No generic charts. Just what works, right now, in 2025.

How Much Should You Save in Emergency Fund? Step-by-Step Calculation Method

Stop using generic advice. Learn the exact step-by-step method to calculate your emergency fund based on your real expenses, income stability, and risks. Get your personalized savings target now.

View More