Emergency Fund Calculation: How Much You Really Need to Save

When life throws a curveball—a car repair, a sudden job loss, or an unexpected medical bill—you don’t want to panic. That’s where an emergency fund, a dedicated stash of cash set aside for unexpected expenses. Also known as emergency savings, it’s the financial buffer that keeps you from going into debt when things go sideways. But here’s the thing: the old rule of thumb—save three to six months of expenses—isn’t one-size-fits-all. Your emergency fund calculation needs to match your real life, not a textbook.

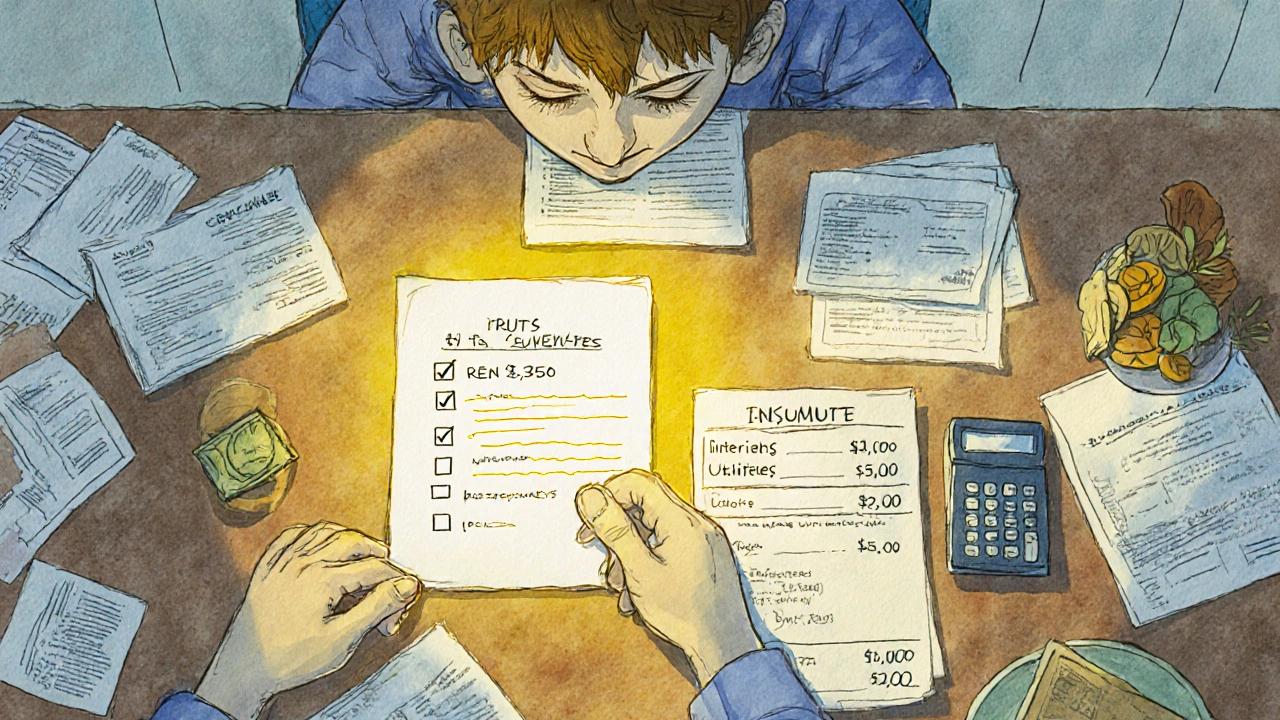

What makes your number different? It’s your income stability. If you’re a freelancer or work in a volatile industry, you might need closer to six months—or even eight. If you’re on a steady salary with good benefits, three months might be enough. But it’s not just about income. Think about your monthly bills: rent, insurance, groceries, phone, internet, car payments. Add them up. Then ask: if you lost your income tomorrow, how long could you cover those without touching credit cards or selling stuff? That’s your baseline. Now factor in your dependents, health needs, or even pet care. A single person with no kids might need less. A parent with two kids and a chronic condition? You’re looking at more. And don’t forget the hidden costs—like replacing a broken laptop you need for work, or a last-minute flight to see a sick relative. These aren’t luxuries. They’re real emergencies.

Your emergency fund, a dedicated stash of cash set aside for unexpected expenses. Also known as emergency savings, it’s the financial buffer that keeps you from going into debt when things go sideways. isn’t just about numbers—it’s about peace of mind. People who have it sleep better. They say no to high-interest loans. They don’t panic-sell investments during market dips. And when they do face a crisis, they handle it with control, not fear. This collection of posts doesn’t just tell you how much to save. It shows you how to build it without feeling broke, how to keep it safe and accessible, and how to adjust it as your life changes. You’ll see real examples from people who’ve been there—how one woman saved $12,000 in 14 months while working part-time, how a remote worker cut her expenses to shrink her target from six to four months, and why holding cash isn’t lazy—it’s strategic. No fluff. No jargon. Just clear steps you can start today.

Below, you’ll find practical guides that cut through the noise. Whether you’re just starting out or you’ve been saving for years but still feel unsure, these posts give you the exact tools and mindset shifts to get it right. No more guessing. No more stress. Just a solid, personalized plan.

How Much Should You Save in Emergency Fund? Step-by-Step Calculation Method

Stop using generic advice. Learn the exact step-by-step method to calculate your emergency fund based on your real expenses, income stability, and risks. Get your personalized savings target now.

View More