Crypto Regulation: What It Means for Your Investments and How It’s Changing

When you buy crypto regulation, the set of rules governments and financial agencies use to oversee digital currencies and blockchain platforms. Also known as digital asset laws, it’s no longer just about stopping scams—it’s about deciding who gets to play, how they play, and what happens when things go wrong. If you’re holding Bitcoin, Ethereum, or even a small pile of altcoins, these rules directly impact your ability to trade, tax your gains, and protect your assets.

SEC crypto, the U.S. Securities and Exchange Commission’s growing role in classifying tokens as securities is one of the biggest forces shaping the landscape. They’ve sued major exchanges like Coinbase and Binance, arguing many coins are unregistered securities. That means if you’re buying a token that acts like an investment contract—where you’re counting on others to make it valuable—you might be holding something the government says isn’t legal unless it’s properly registered. Meanwhile, blockchain compliance, the systems and processes exchanges and wallets use to follow anti-money laundering and know-your-customer rules are becoming standard. Even small investors now face KYC checks, transaction monitoring, and reporting requirements that didn’t exist five years ago.

It’s not just the U.S. Either. The EU’s MiCA law is forcing crypto firms to publish white papers, prove they’re solvent, and protect customer funds. Japan requires exchanges to be licensed. India taxes crypto trades like capital gains. These aren’t suggestions—they’re legal requirements. And they’re changing how platforms operate. Some services you used to rely on? They’ve pulled out of certain countries. Others now limit what you can buy or how fast you can withdraw. The goal? Reduce fraud, protect consumers, and bring crypto into the same financial sandbox as stocks and bonds.

But here’s the thing: regulation isn’t just a threat. It’s also a signal. When governments step in with clear rules, it tells institutional money—pension funds, hedge funds, banks—that this isn’t a wild gamble anymore. That’s why you’re seeing BlackRock, Fidelity, and others launch crypto ETFs. They didn’t jump in until they had legal clarity. And that clarity? It’s coming from regulation.

So what does this mean for you? If you’re trading on an unregulated platform, you’re taking bigger risks. If you’re ignoring tax reporting, you’re setting yourself up for trouble. But if you’re using a compliant exchange, keeping records, and understanding how your coins are classified, you’re not just following the rules—you’re positioning yourself for the next phase of crypto’s growth. The wild west is over. The rulebook is being written right now. And you’re not just watching—you’re playing.

Below, you’ll find real, practical breakdowns of how these rules affect your portfolio, which platforms are safest, how taxes work, and what to watch for next. No fluff. Just what you need to know to invest smarter in a regulated world.

Fintech Regulations: Global Overview and Compliance in 2025

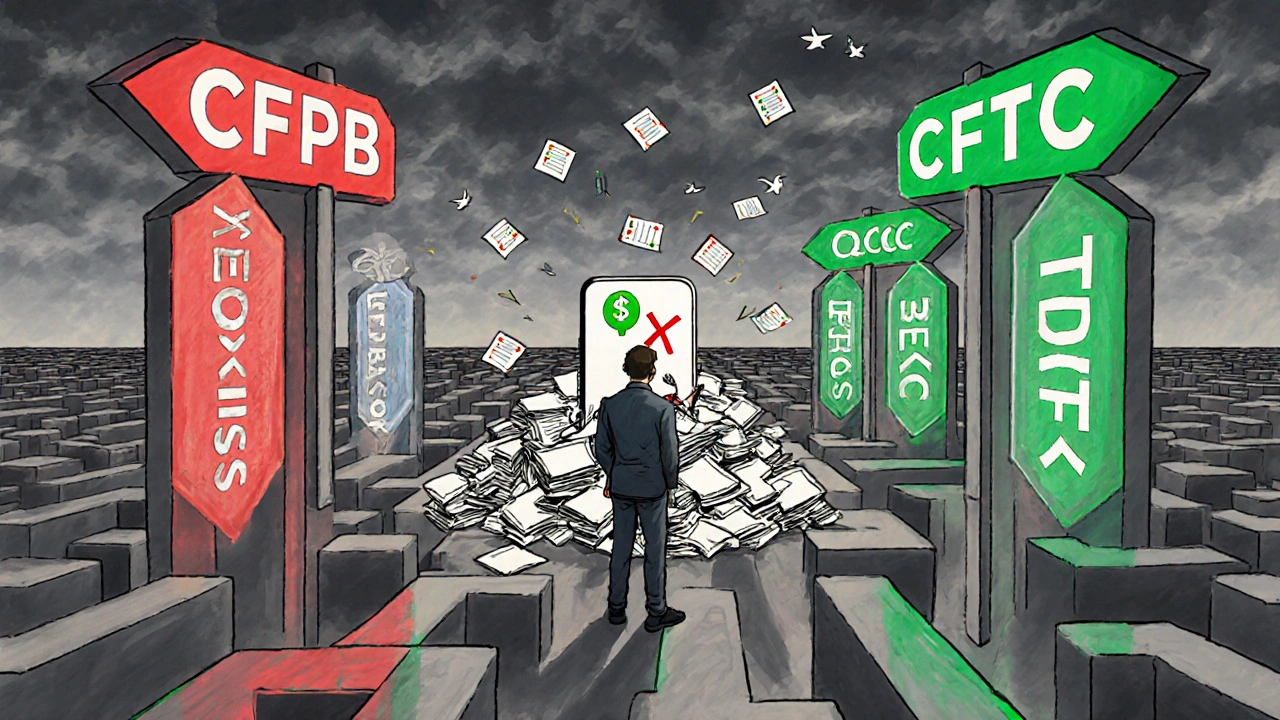

Fintech regulations in 2025 are fragmented, complex, and rapidly evolving. From the EU's MiCA to the U.S. CFPB's Section 1033, compliance is no longer optional-it's a core part of product development. This guide breaks down global rules, costs, and strategies to stay ahead.

View More