Credit Backing: What It Is and How It Powers Your Finances

When you swipe a card or pay with a digital wallet, credit backing, the guarantee that a payment will be settled by a financial institution or network. Also known as payment guarantee, it’s the invisible engine that makes modern money work—whether you’re buying coffee or funding a startup. Without it, your card would just be plastic. Credit backing isn’t just about banks saying "yes"—it’s about networks like Visa and Mastercard standing behind the transaction, ensuring the merchant gets paid even before the buyer’s account is fully verified.

This system ties directly to payment processing infrastructure, the hidden network of banks, processors, and card networks that move money from your device to a merchant’s account. It also connects to fraud detection systems, AI-driven tools that monitor transactions in real time to spot anomalies and prevent unauthorized use. When fraud is caught, credit backing steps in to reverse the charge and protect you—without you lifting a finger. And it’s not just for cards. Even QR code payments and BNPL options rely on credit backing to ensure the merchant isn’t left holding the bag if the buyer defaults.

Behind every successful transaction is a chain of trust: your bank approves the spend, the network validates it, and the processor settles it—all under the umbrella of credit backing. That’s why fintech companies spend millions getting certified by card schemes and why compliance with rules like PSD2 and MiCA matters so much. It’s not red tape—it’s the foundation that lets you pay with your phone in India, invest through a robo-advisor in the U.S., or use a digital envelope budgeting app without worrying about failed payments.

You don’t see credit backing, but you feel its effects every time a payment goes through. It’s what lets you dollar-cost average with your paycheck, rebalance your portfolio without cash flow hiccups, or use a stop-loss order without fear that your broker can’t execute the trade. It’s the reason your REIT ETFs settle cleanly, your tax-loss harvesting moves complete on time, and your fintech app doesn’t crash when 10,000 users hit the buy button at once.

What you’ll find below isn’t just a list of articles—it’s a map of how credit backing touches every corner of modern finance. From how AI spots fraud before it happens, to how open finance expands who can access credit-backed systems, to how payment observability keeps the whole chain running smooth—you’ll see exactly how this invisible force shapes your money, your choices, and your wealth.

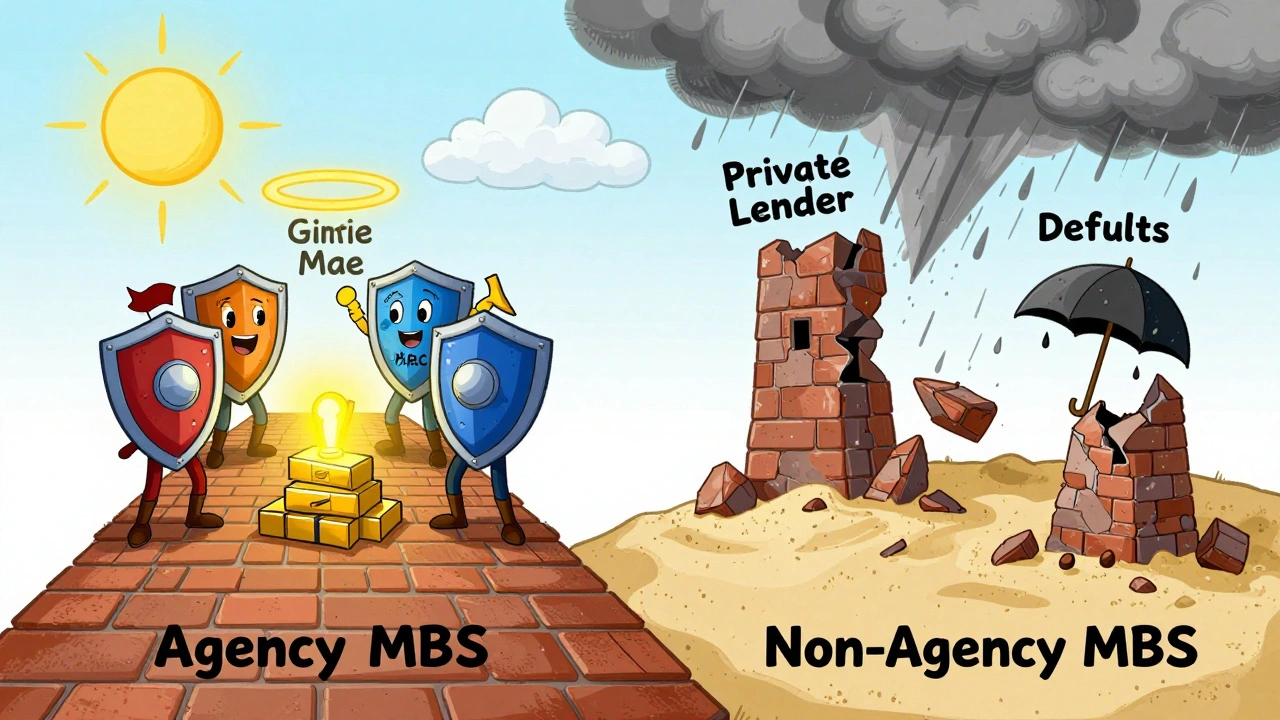

Agency MBS vs Non-Agency MBS: Understanding Credit Backing Differences

Understand the critical difference between agency and non-agency MBS: one has government backing, the other doesn't. Learn how credit risk, yields, liquidity, and structure impact your fixed-income investments.

View More