Collar Strategy: How to Protect Your Stock Investments with Options

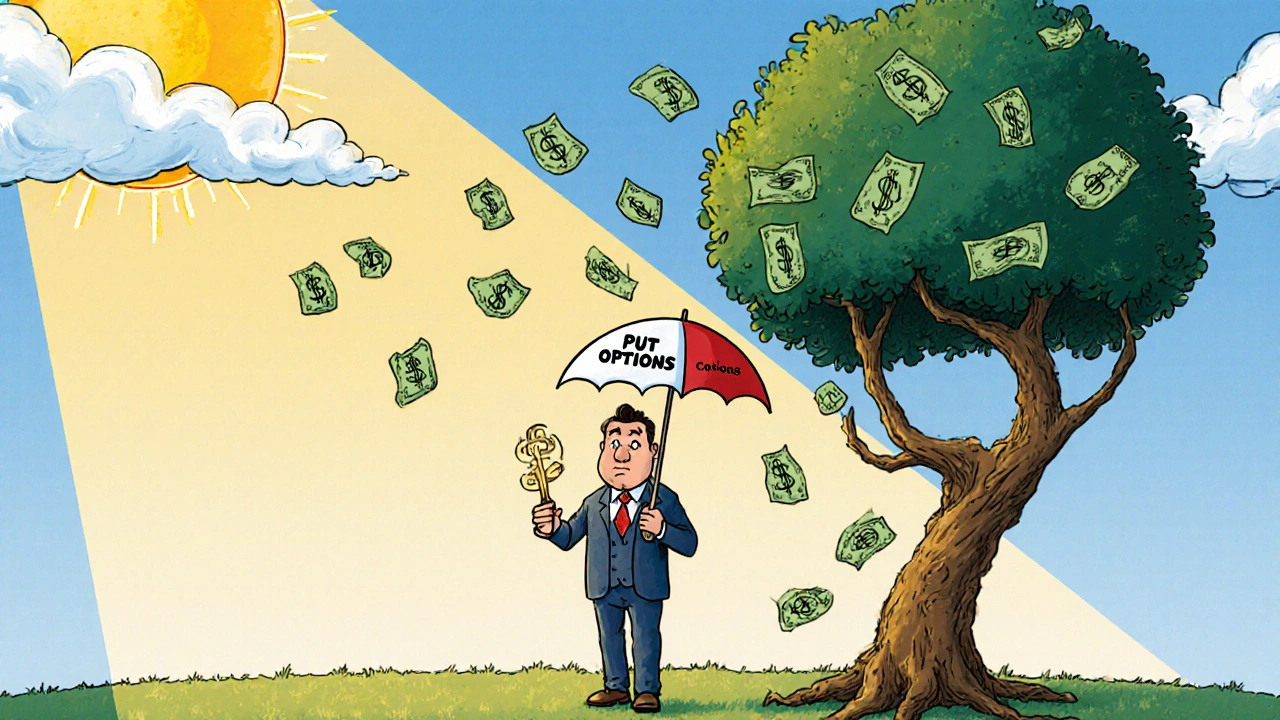

When you own stock and want to protect it without selling, a collar strategy, a risk management technique that combines a protective put and a covered call to limit both upside and downside. Also known as a ratio spread, it’s not about guessing where the market will go—it’s about setting boundaries so you sleep better at night. This isn’t gambling. It’s insurance. You’re not trying to make a killing. You’re trying to keep what you’ve got.

The protective put, an options contract that gives you the right to sell your stock at a set price, even if the market crashes is your safety net. If your stock drops 30%, you’re still protected. The covered call, a contract where you sell someone else the right to buy your stock at a higher price pays you cash upfront. That cash often covers the cost of the put. In many cases, the whole collar costs nothing. You’re not paying for protection—you’re getting paid for it.

This strategy works best for investors who are happy to cap their gains. If your stock surges past the call strike, you’ll miss out on the extra profit. But that’s the trade-off. You give up some upside to avoid a big loss. It’s not for people chasing moonshots. It’s for people who bought Apple at $100 and are now sitting on $200 but don’t want to watch it drop back to $120. It’s for retirees holding dividend stocks. It’s for anyone who wants to hold on but can’t stomach another 2022-style crash.

What you won’t find here is complex jargon or options Greeks. You’ll find real examples: how a tech investor locked in gains on NVIDIA in 2023, how a small investor used a collar on Meta to avoid a $15K loss, how a retiree turned a $50K position into a risk-free income stream. These aren’t theoretical exercises. They’re real moves made by people who didn’t want to panic-sell or sit idle.

You’ll also see how this connects to other ideas you’ve read here—like stop-loss orders (which often fail in fast markets), dollar-cost averaging (which builds positions slowly), and partial rebalancing (which keeps your portfolio steady). The collar strategy is the missing link: it’s what you do after you’ve bought, after you’ve held, and before you decide to sell.

There’s no magic here. No secret formula. Just a simple, proven way to take emotion out of investing. If you’ve ever held a stock too long because you didn’t want to realize a loss—or sold too early because you were scared—you already know why this matters. The collar strategy doesn’t promise returns. It promises control. And in today’s market, that’s worth more than most people realize.

Portfolio Hedging with Options: Protect Your Investments Using Puts, Collars, and Spreads

Learn how to protect your investment portfolio from market crashes using puts, collars, and spreads. Discover practical, real-world strategies that work in 2025 without selling your holdings.

View More