CFPB Section 1033: What It Means for Your Financial Data Rights

When you use a bank app, robo-advisor, or budgeting tool, CFPB Section 1033, a rule from the Consumer Financial Protection Bureau that gives consumers the right to access and share their financial data with third-party services. Also known as the data access rule, it doesn’t just apply to big banks—it reshapes how you control your money in the digital age. Before this rule, your bank owned your transaction history. You could get a statement, sure, but you couldn’t easily send it to a budgeting app, investment platform, or loan comparison tool without jumping through hoops—or paying for it. Section 1033 changed that. It says: your data is yours. And if you want to use a better tool to track your spending, automate investing, or compare loan rates, you should be able to do it without begging your bank for permission.

This rule connects directly to tools you’re already using. Think about data portability, the ability to move your financial information between services without manual entry or paper forms. That’s what Section 1033 enforces. It’s why you can link your Chase account to Mint or SoFi Invest without logging into your bank’s website every time. It’s why platforms like YNAB and Personal Capital can pull in your spending data securely. And it’s why robo-advisors like Betterment or Wealthfront can automatically rebalance your portfolio based on your real-time balances. Without Section 1033, these services would be clunky, slow, or impossible. The rule also ties into financial privacy, how your data is protected once it leaves your bank and enters a third-party app. Just because you can share your data doesn’t mean every app deserves it. Section 1033 requires companies to handle your information securely, and it gives you the right to revoke access anytime.

What you’ll find in this collection isn’t just theory. These articles show you how Section 1033 plays out in real life: how it enables automated investing, how it affects your emergency fund tracking, and why it’s the quiet engine behind tools that help you save smarter. You’ll see how it connects to client money rules, robo-advisors, and even how banks respond when customers demand more control. This isn’t about regulatory jargon—it’s about you having real power over your money. And if you’re using any digital finance tool, you’re already living under this rule. Now you know why.

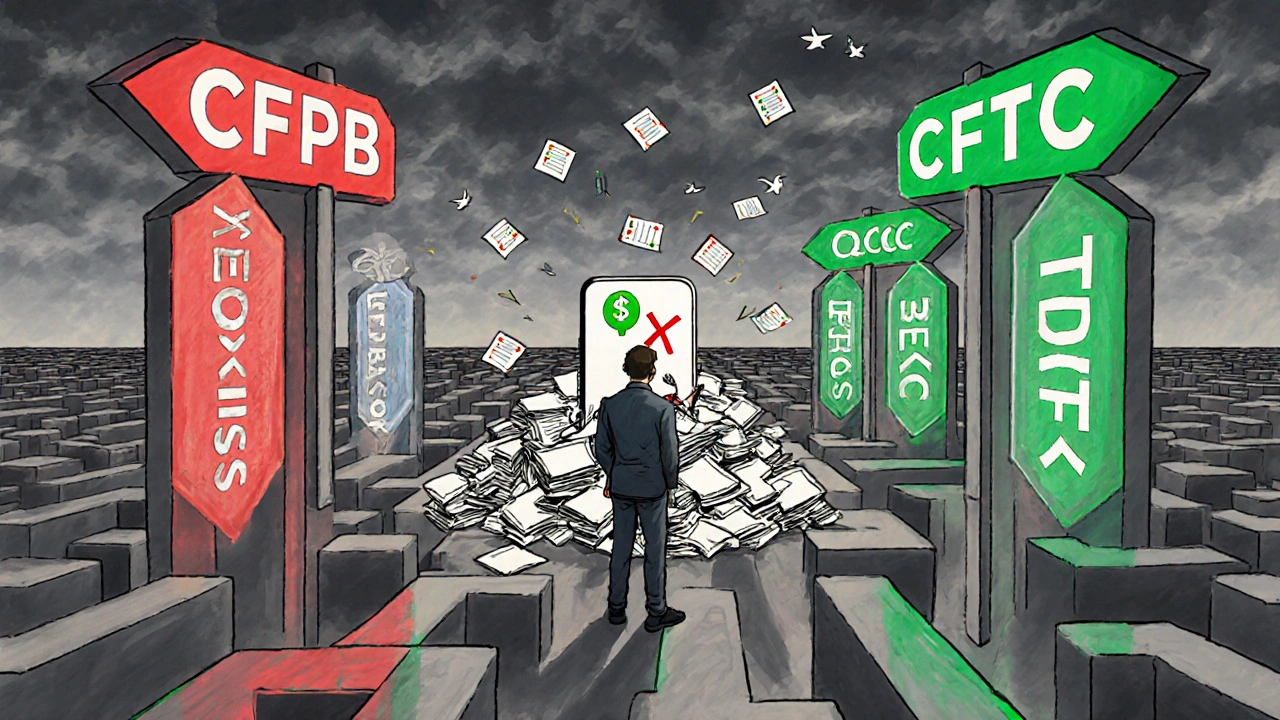

Fintech Regulations: Global Overview and Compliance in 2025

Fintech regulations in 2025 are fragmented, complex, and rapidly evolving. From the EU's MiCA to the U.S. CFPB's Section 1033, compliance is no longer optional-it's a core part of product development. This guide breaks down global rules, costs, and strategies to stay ahead.

View More