Agency MBS: How Government-Sponsored Entities Shape Mortgage Markets

When you hear agency MBS, mortgage-backed securities issued by U.S. government-sponsored enterprises like Fannie Mae, Freddie Mac, and GNMA. Also known as government-sponsored enterprise MBS, these are the most trusted form of mortgage-backed investing because they carry an implicit federal guarantee. Unlike private MBS, which crashed in 2008, agency MBS are backed by real government entities that pool thousands of home loans and sell shares to investors. This structure keeps mortgage rates low for homeowners and gives investors steady, predictable income—with far less risk.

Agency MBS rely on three main players: Fannie Mae, a government-sponsored enterprise that buys mortgages from lenders and packages them into securities, Freddie Mac, its sister agency that does the same thing but focuses on different lenders, and GNMA (Ginnie Mae), a true government agency that backs loans insured by the FHA, VA, and USDA. While Fannie and Freddie are technically private companies under federal oversight, their securities are treated like government bonds because the U.S. Treasury stepped in to save them during the financial crisis. GNMA, on the other hand, has an explicit full faith and credit guarantee from the U.S. government.

These aren’t just Wall Street tools—they’re the reason millions of Americans can get 30-year fixed mortgages at 6% instead of 10%. By buying agency MBS, investors give banks the cash to keep lending. That’s why you’ll see them in robo-advisor portfolios, pension funds, and even some ETFs focused on fixed income. They’re not flashy, but they’re stable. And in a world of volatile crypto and unpredictable stocks, that stability matters.

You won’t find agency MBS in every investment guide, but they’re quietly behind the scenes in most people’s retirement accounts. If you’ve ever held a bond fund or a treasury ETF, chances are it includes some agency MBS. They pay monthly interest, not just semi-annual like Treasuries, and their prepayment risk—when homeowners refinance—is the only real downside. But even that’s managed better here than in private deals.

The posts below break down how agency MBS connect to broader financial systems: how they’re priced, how they affect interest rates, how AI tracks prepayment patterns, and why they’re still the safest way to get exposure to housing without buying a home. You’ll also see how they relate to things like open finance, payment infrastructure, and even fintech compliance—because behind every MBS is a web of data, rules, and technology keeping the system running. Whether you’re new to bonds or already managing a portfolio, understanding agency MBS means understanding how the U.S. housing economy actually works.

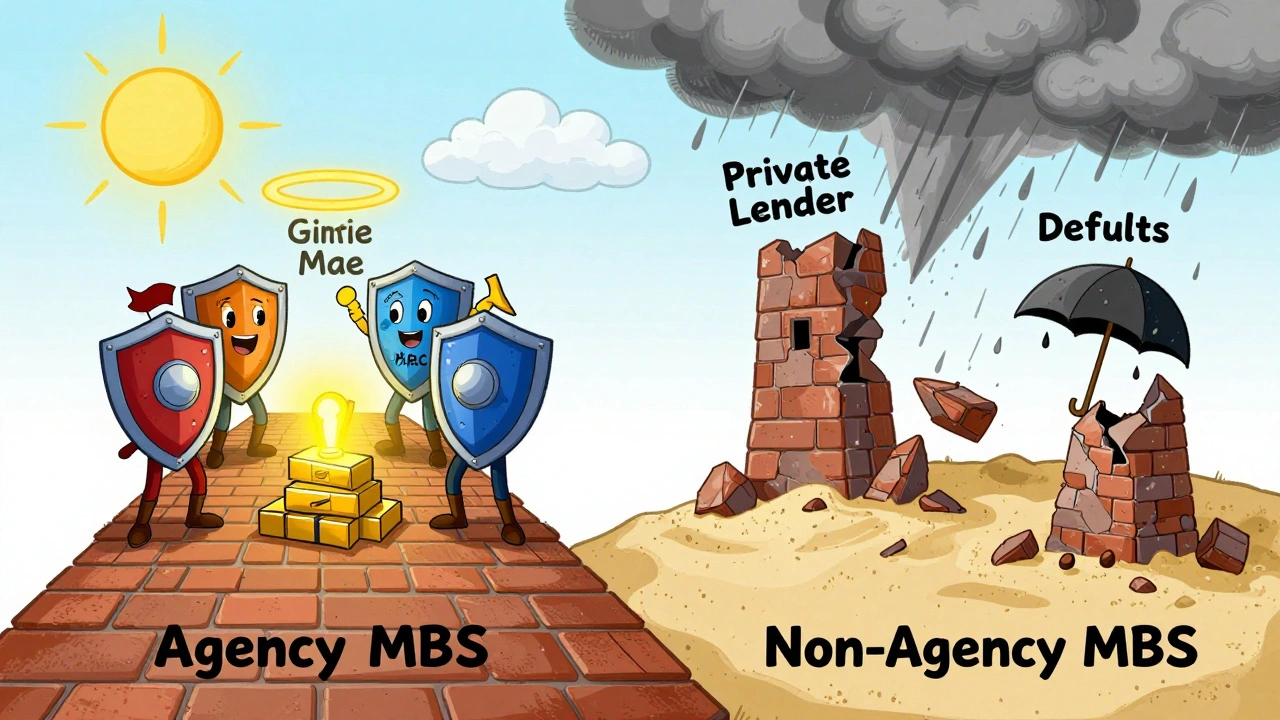

Agency MBS vs Non-Agency MBS: Understanding Credit Backing Differences

Understand the critical difference between agency and non-agency MBS: one has government backing, the other doesn't. Learn how credit risk, yields, liquidity, and structure impact your fixed-income investments.

View More