Sunk Cost Fallacy: Why You Keep Losing Money and How to Stop

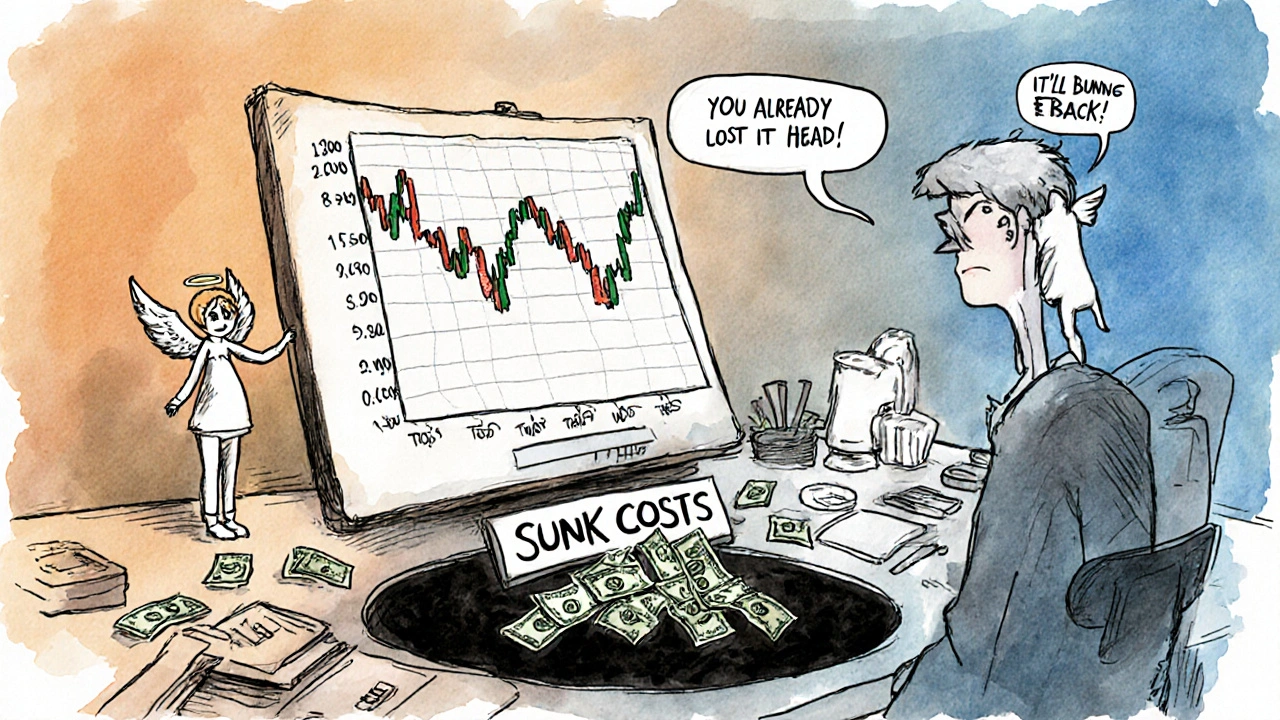

When you keep throwing good money after bad—like holding onto a losing stock because you already spent $5,000 on it—you’re falling for the sunk cost fallacy, a psychological trap where past investments distort current decisions. Also known as throwing good money after bad, it’s not about logic—it’s about pride, fear, and the uncomfortable feeling of admitting you were wrong. This isn’t just a money mistake. It’s a brain glitch that shows up in investing, relationships, careers, and even that gym membership you never use.

The sunk cost fallacy is a cognitive bias rooted in loss aversion, a core idea in behavioral finance, the study of how emotions and mental shortcuts drive financial choices. Your brain hates admitting failure, so it clings to past effort—even when the future looks worse. You don’t sell the stock because you don’t want to lock in the loss. You keep paying for the software you hate because you already paid for a year. You stay in a job that drains you because you’ve invested five years. But here’s the truth: the money, time, or effort you already spent is gone. It can’t be recovered. What matters now is what happens next.

This isn’t theoretical. In our posts, you’ll see how this bias shows up in real investing. People hold onto crypto that dropped 80% because they bought at the peak. They stick with a robo-advisor that charges too much because they’ve been with them for years. They ignore better ETFs because switching feels like losing. But the market doesn’t care about your history. It only responds to current value. The smartest move isn’t doubling down—it’s cutting your losses and moving on. That’s not failure. That’s strategy.

Breaking free takes practice. Start by asking: "If I didn’t own this right now, would I buy it today?" If the answer is no, you’re already holding it because of the past. That’s the fallacy talking. The next time you feel stuck, pause. Look at the numbers. Ignore the emotional weight of what you’ve already spent. Focus only on what’s ahead. That’s how you turn a mental trap into a clear, profitable decision.

Below, you’ll find real examples from our guides—how investors get trapped, how they break free, and the simple tools that help you think differently. No fluff. Just what works.

Why You Keep Holding Losing Investments: Hope Bias and Sunk Costs Explained

Why do investors hold losing stocks too long? It's not about the market-it's about hope bias and the sunk cost fallacy. Learn how your brain tricks you and what to do instead.

View More