Student Loan Refinancing: How to Lower Payments and Save Thousands

When you student loan refinancing, the process of replacing your existing student loans with a new loan from a private lender, usually at a lower interest rate. Also known as private student loan consolidation, it’s not just a reset—it’s a financial move that can cut your monthly bill by hundreds and save you tens of thousands over time. This isn’t for everyone, but if you’ve got steady income, decent credit, and loans with high rates, it’s one of the smartest financial decisions you can make after graduation.

Refinancing works because private lenders compete for your business. They look at your income, credit score, and debt-to-income ratio—not just your school or degree. If you’ve improved your finances since college, you might qualify for a rate under 4%, even if your original loans were at 6% or higher. That’s not a small difference. On a $30,000 loan, dropping from 6% to 4% can save you over $5,000 in interest and shave off years from your repayment timeline. And unlike federal loans, refinanced loans often let you pick your term: 5, 10, or even 20 years. Shorter terms mean higher payments but less total cost. Longer terms mean lower payments but more interest paid. You get to choose.

But here’s what most people miss: refinancing means giving up federal protections. If you have income-driven repayment plans, loan forgiveness programs, or deferment options because of unemployment or hardship, you lose those when you refinance. That’s why it’s only smart if you’re confident in your job stability and don’t plan to pursue Public Service Loan Forgiveness. If you’re in a stable career, have no plans for forgiveness, and want to get out of debt faster, refinancing is a powerful tool. It’s also worth comparing lenders—not just the big names, but newer fintech lenders that offer cash bonuses or rate discounts for automatic payments.

Some lenders let you refinance both federal and private loans together. Others only take private ones. Some let you refinance multiple times if rates drop again. And if you have a co-signer with great credit, you might qualify for a rate you couldn’t get on your own. The key is to shop around. A 0.5% difference in rate on a $50,000 loan adds up to over $1,500 in savings over 10 years. That’s a vacation. That’s extra retirement contributions. That’s breathing room.

You don’t need to be a finance expert to do this. You just need to know your numbers: how much you owe, what your current rates are, and what your monthly payment feels like. Then compare offers. No credit check until you’re ready to apply—most lenders do a soft pull first. And if you’re still in school or just graduated, wait until you’ve got a job. Lenders want proof you can pay. But once you do, refinancing isn’t just a smart move—it’s one of the few times in personal finance where you can directly control your debt cost without changing your lifestyle.

Below, you’ll find real breakdowns, lender comparisons, and strategies from women who’ve done this successfully—some saved over $10,000. No fluff. Just what works.

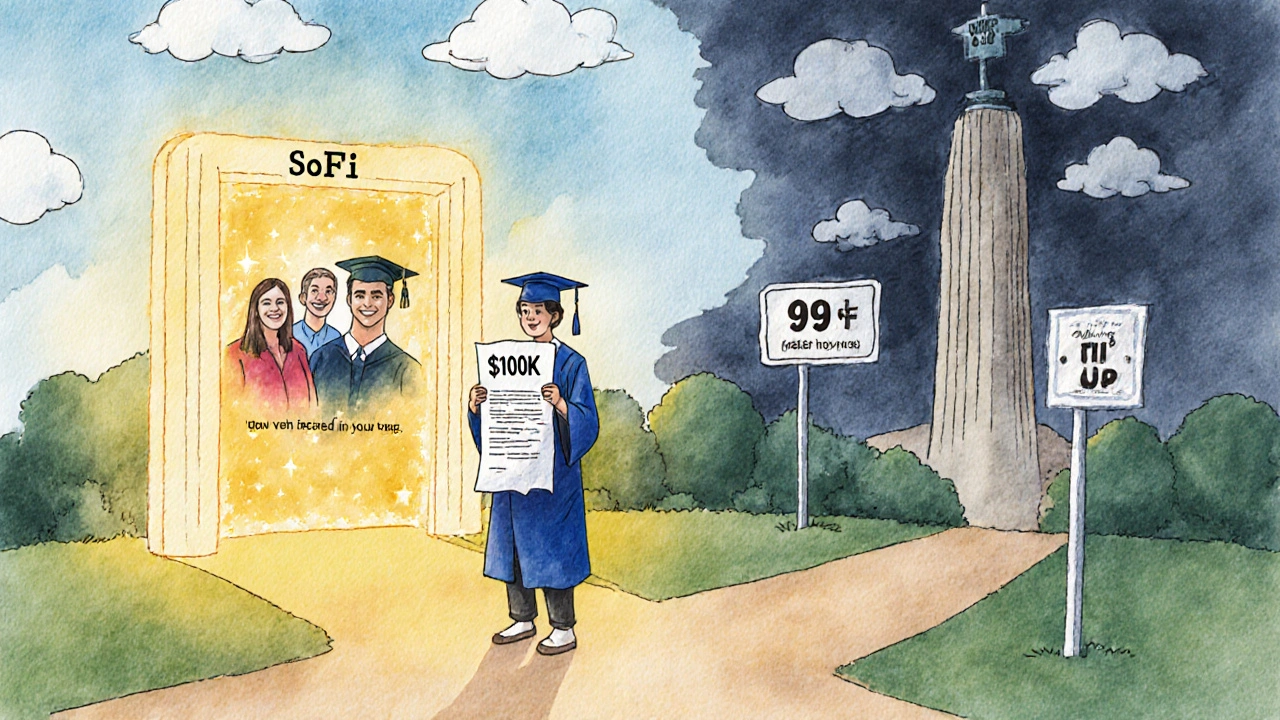

SoFi: From Student Loans to Full-Service Finance

SoFi began as a student loan refinancing platform and grew into a full-service digital bank offering checking, savings, investing, mortgages, and more - all in one app. Here's how it works, who it's for, and whether it's right for you.

View More