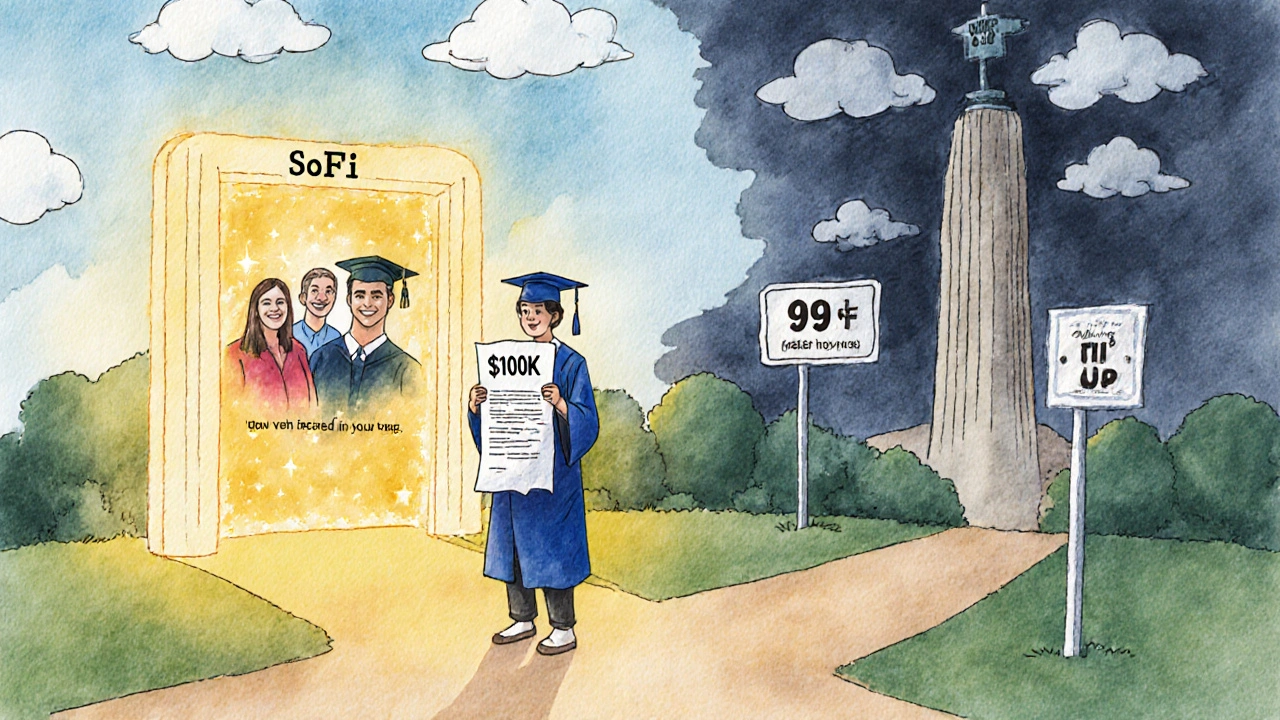

SoFi Money: What It Is, How It Works, and Why It Matters for Tech-Savvy Investors

When you think of SoFi Money, a digital checking and savings account designed for modern users who want banking without the bureaucracy. Also known as SoFi Checking and Savings, it’s not just another app—it’s a financial hub that lets you track spending, earn interest, and invest all in one place. Unlike traditional banks that charge fees for everything from ATM use to overdrafts, SoFi Money gives you unlimited fee-free ATM access, no monthly fees, and cash-back rewards on debit card purchases. It’s built for people who want their money to work harder—without needing a finance degree to figure it out.

SoFi Money isn’t a bank. It’s a cash management account, a hybrid product that combines checking, savings, and investment features under one digital roof. Also known as digital wallet banking, it’s powered by partner banks like Evolve Bank & Trust and Wells Fargo, which handle the FDIC insurance behind the scenes. This means your money is protected up to $250,000 per institution, but you get the user experience of a sleek fintech app—no branch visits, no paper statements, no confusing menus. The SoFi app, the central interface for managing your money, investments, and financial goals. Also known as SoFi mobile app, it lets you see your balance, set up automatic transfers, and even get early access to paychecks—all from your phone.

What makes SoFi Money stand out isn’t just the features—it’s the mindset. It’s designed for people who already use apps to order food, book rides, or track workouts, and now want the same simplicity with their money. You can link your paycheck directly, set up round-ups to save spare change, and earn 4.60% APY on savings (as of 2025). There’s no minimum balance. No hidden fees. No jargon. And if you’re already using SoFi for student loans or investing, your accounts sync automatically, so you see your full financial picture in one place. It’s not magic—it’s smart design.

But here’s the thing: SoFi Money isn’t for everyone. If you need wire transfers, certified checks, or in-person customer service, you might miss those old-school options. But if you’re someone who checks your phone more often than your mailbox, who cares about earning interest on every dollar, and who wants to cut through banking clutter—this is one of the cleanest tools out there. It’s not just a checking account. It’s a way to take control of your money without the headache.

Below, you’ll find real-world insights from people who’ve used SoFi Money to simplify their finances, automate savings, and connect their spending to their long-term goals. Whether you’re just starting out or already managing multiple accounts, these posts break down what works, what doesn’t, and how to make the most of it without overcomplicating your life.

SoFi: From Student Loans to Full-Service Finance

SoFi began as a student loan refinancing platform and grew into a full-service digital bank offering checking, savings, investing, mortgages, and more - all in one app. Here's how it works, who it's for, and whether it's right for you.

View More