SoFi Invest: What It Is, How It Works, and Why It Matters for Women Investing Online

When you hear SoFi Invest, a fee-free, mobile-first automated investing platform designed for beginners and intermediate investors. Also known as SoFi Automated Investing, it's one of the few platforms that lets you start with $1, trade commission-free, and get basic financial planning tools—all in one app. Unlike traditional brokerages that charge per trade or require minimum deposits, SoFi Invest removes the friction that often keeps women from starting. It’s not just about low fees—it’s about making investing feel less intimidating, less complex, and more like a habit you can build while scrolling through your phone.

SoFi Invest runs on a robo-advisor, an automated system that builds and manages diversified portfolios based on your goals and risk tolerance, using mostly low-cost ETFs. It doesn’t pick individual stocks or time the market. Instead, it uses modern portfolio theory to spread your money across U.S. and global markets. If you’ve read about tax-loss harvesting, a strategy that sells losing investments to reduce your tax bill, you’ll know it’s a feature offered by platforms like Betterment and Wealthfront—but SoFi doesn’t offer it. That’s a trade-off. You get simplicity and zero fees, but fewer advanced tools. Still, for someone who just wants to automate savings and avoid emotional decisions, that’s often enough.

What makes SoFi Invest stand out isn’t just the price—it’s the ecosystem. If you use SoFi for banking, loans, or credit cards, your investing account ties into the same app. That means you can move money between your checking account and investments in seconds, without logging into a separate platform. For women juggling multiple financial apps, this integration saves time and reduces mental load. It also helps you see your whole financial picture: how much you’ve saved, how much you owe, and how your investments are growing—all in one place.

But it’s not perfect. SoFi Invest doesn’t offer IRAs with Roth options as of 2025, which limits its usefulness for long-term retirement planning. If you’re serious about tax-advantaged growth, you’ll need to pair it with another platform. It also lacks detailed research tools or educational content beyond basic tips. You won’t find deep dives into bond ladders, ESG portfolios, or international index fund allocation here. That’s not its job. Its job is to get you started, keep you consistent, and remove the barriers that make investing feel like a chore.

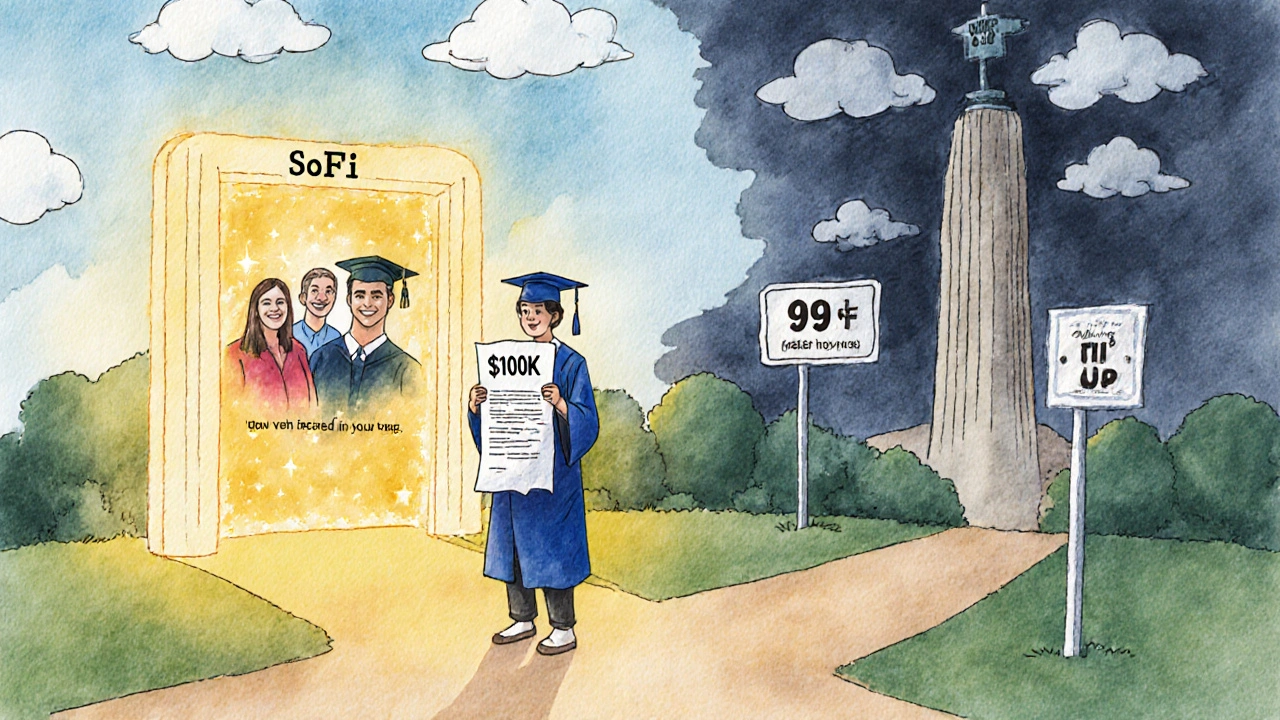

If you’ve ever felt overwhelmed by broker comparisons, confused by fee structures, or stuck in analysis paralysis trying to pick the "best" platform, SoFi Invest cuts through the noise. It doesn’t promise to make you rich. It promises to help you show up. And for most people—especially women starting out with limited time or confidence—that’s the real win.

Below, you’ll find real reviews, comparisons, and breakdowns of how SoFi Invest stacks up against other tools like Robinhood, Wealthfront, and Vanguard. You’ll learn when it’s the right choice—and when you’re better off looking elsewhere.

SoFi: From Student Loans to Full-Service Finance

SoFi began as a student loan refinancing platform and grew into a full-service digital bank offering checking, savings, investing, mortgages, and more - all in one app. Here's how it works, who it's for, and whether it's right for you.

View More