SoFi: What It Is, How It Works, and Why It Matters for Tech-Savvy Investors

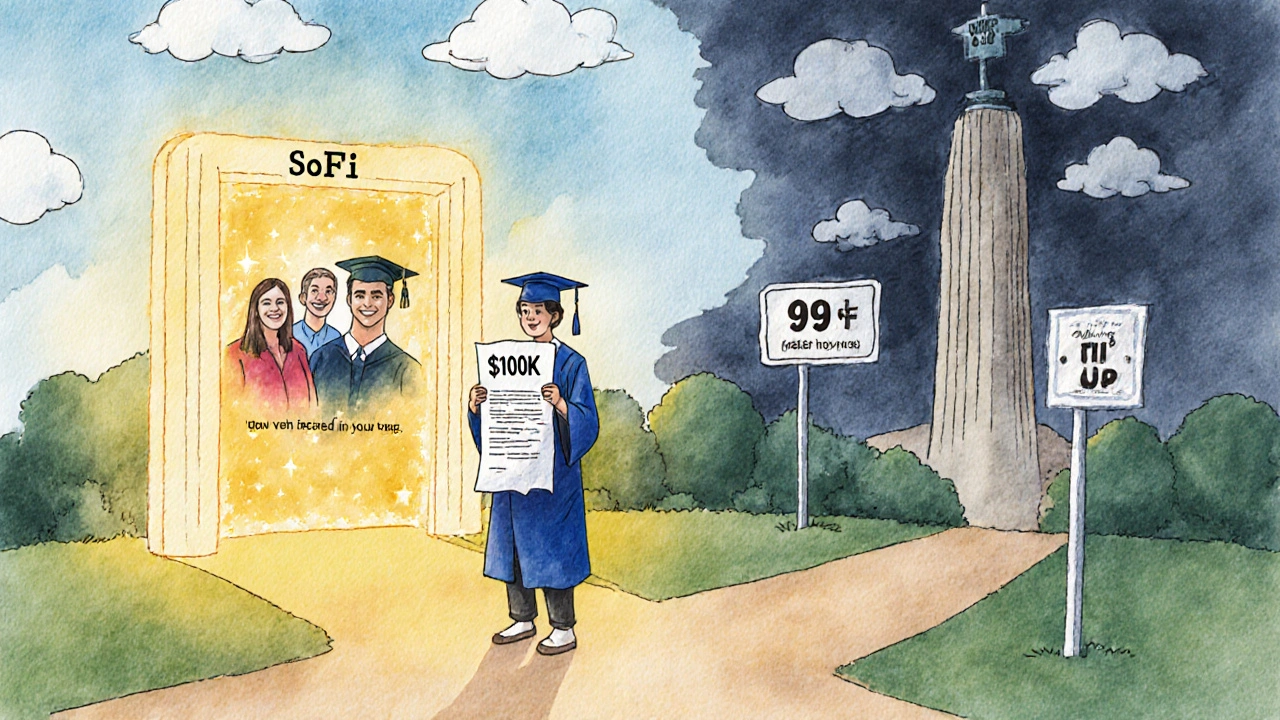

When you think of SoFi, a digital financial services platform that combines banking, investing, lending, and wealth management in one app. Also known as SoFi Technologies, it's one of the first fintech companies to build a full money ecosystem for everyday users—not just investors or high-net-worth clients. Unlike traditional banks, SoFi doesn’t just give you an account—it gives you tools to automate your money, cut fees, and grow wealth without needing a financial advisor. It’s built for people who want control, clarity, and convenience—all from their phone.

SoFi isn’t just about student loan refinancing anymore. It’s now a robo-advisor, an automated investment platform that builds and manages diversified portfolios based on your goals and risk tolerance. Also known as SoFi Invest, it lets you start with as little as $1 and automatically rebalances your portfolio, offers tax-loss harvesting, and includes access to fractional shares of ETFs and stocks. This is the kind of feature that used to be locked behind $100,000 minimums at firms like Vanguard or Fidelity—now it’s free and built into the same app where you check your balance. And if you’re wondering how it compares to Betterment or Wealthfront, the big difference is SoFi bundles everything: checking, savings, investing, and even credit cards—all under one login. No more juggling five apps just to manage your money.

What makes SoFi stand out isn’t just its features—it’s how it thinks about money. It treats your cash like a strategic asset, not just something to keep safe. That’s why it offers high-yield savings accounts with no fees, free ATM access nationwide, and even career coaching as part of its membership. It’s not just fintech—it’s digital banking, a modern approach to financial services that replaces brick-and-mortar banks with seamless apps, real-time insights, and personalized guidance. Also known as neobank, it’s the reason why millions of women under 40 are leaving big banks behind. You don’t need to be a tech expert to use it, but you do need to know what you’re looking for. And that’s where this collection comes in.

Below, you’ll find real breakdowns of how SoFi compares to other platforms, what fees you’re really paying, how its investing tools stack up against competitors, and why some users get stuck in the app while others build real wealth. You’ll see data on its tax-loss harvesting thresholds, how its cash management account performs in rising rate environments, and whether its automated investing is actually better than doing it yourself. No fluff. No hype. Just what works—and what doesn’t—based on real user behavior and market conditions in 2025.

SoFi: From Student Loans to Full-Service Finance

SoFi began as a student loan refinancing platform and grew into a full-service digital bank offering checking, savings, investing, mortgages, and more - all in one app. Here's how it works, who it's for, and whether it's right for you.

View More