Investor Mistakes: Common Errors and How to Avoid Them

When people make investor mistakes, costly errors driven by psychology, not market conditions. Also known as behavioral finance errors, these aren’t about not knowing enough—they’re about acting on instincts that worked in the Stone Age but wreck portfolios today. You don’t need a finance degree to mess up your money. You just need to be human.

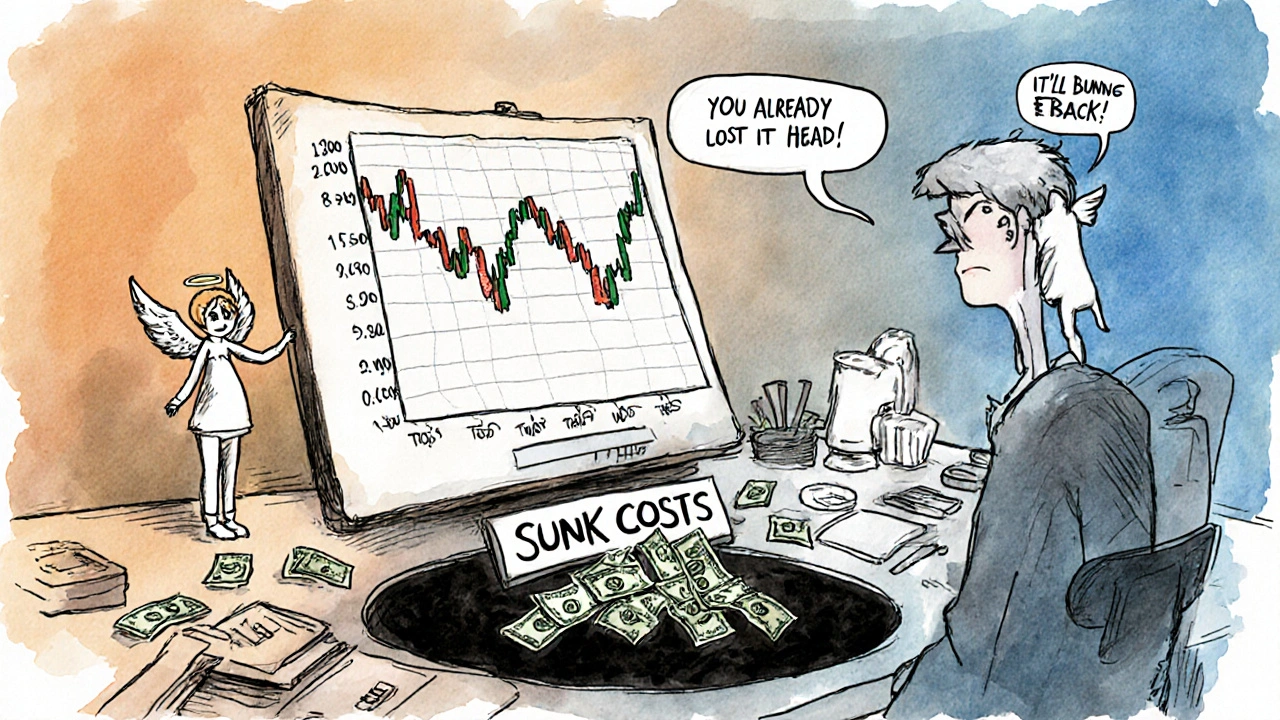

One of the biggest traps is loss aversion, the urge to hold onto losing investments because selling feels like admitting defeat. It’s why people keep holding a stock that’s down 40% while ignoring better opportunities. Another is overconfidence bias, thinking you can time the market or pick winners better than professionals. Studies show that 80% of individual traders lose money over time—not because they’re dumb, but because they trade too much and too emotionally. Then there’s herd behavior, jumping into crypto or AI stocks just because everyone else is. You’re not investing—you’re chasing noise.

These aren’t abstract ideas. They show up in real decisions: selling during a crash, buying at a peak, ignoring fees, or keeping cash in a 0.01% savings account while inflation eats it. The posts below don’t just list these mistakes—they show you exactly how they played out in real portfolios, what the data says about recovery, and how to build habits that protect you from your own brain.

You’ll find real examples: how a woman held onto a failing tech stock for two years because she didn’t want to book a loss, how another kept switching robo-advisors every six months chasing "better returns," and why someone with a $500K portfolio still didn’t have an emergency fund. These aren’t hypotheticals. They’re stories from people who thought they were doing everything right—until they looked at the numbers.

There’s no magic formula to avoid investor mistakes. But there *is* a pattern: awareness, structure, and silence. Know your biases. Build rules that override your impulses. And then, don’t touch your portfolio unless the plan says so. The posts here give you those rules—clear, practical, and tested. No jargon. No hype. Just what works when your emotions are screaming and the market is moving.

Why You Keep Holding Losing Investments: Hope Bias and Sunk Costs Explained

Why do investors hold losing stocks too long? It's not about the market-it's about hope bias and the sunk cost fallacy. Learn how your brain tricks you and what to do instead.

View More