International Index Funds: How to Invest Globally with Low-Cost ETFs

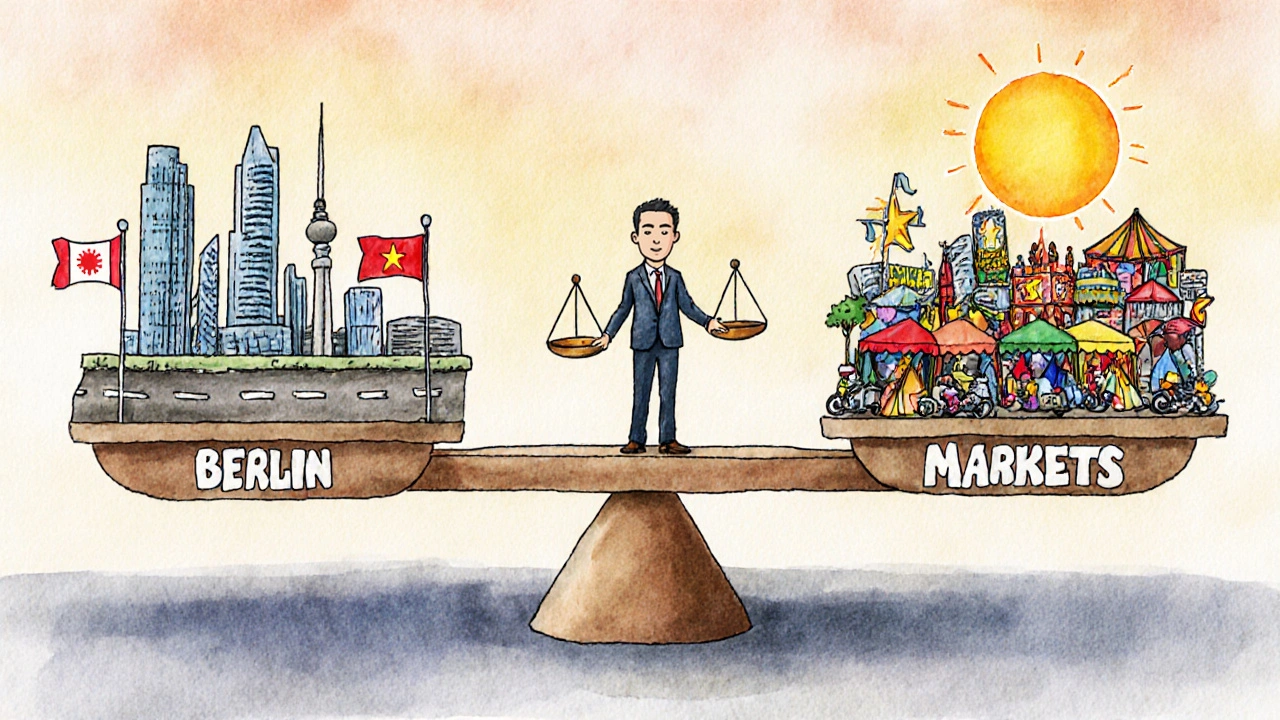

When you invest in international index funds, mutual funds or ETFs that track stock markets outside the United States. Also known as global equity funds, they let you own pieces of companies in Europe, Asia, Latin America, and beyond—without picking single stocks. This isn’t just about spreading risk. It’s about tapping into growth that’s happening right now in places like India, Brazil, or Vietnam, where economies are expanding faster than the U.S. right now.

Most people stick to U.S. stocks because they’re familiar, but that’s like only eating one type of food. The world has more than 90% of the global stock market value outside the U.S., and emerging markets, countries with rapidly growing economies and expanding middle classes. Also known as developing markets, they include nations like Indonesia, Nigeria, and Mexico. These aren’t risky bets—they’re core parts of a balanced portfolio. Asset allocation, how you divide your money among different types of investments. Also known as portfolio diversification, it’s the single most powerful tool to reduce volatility and boost long-term returns. International index funds are one of the easiest, cheapest ways to get this right.

Many investors think they need to pick individual foreign stocks or time global markets. You don’t. You just need exposure. A single international index fund can give you hundreds of companies across dozens of countries, all for under 0.2% in fees. That’s cheaper than most U.S. index funds. And unlike trying to guess which country will outperform next year, these funds track broad benchmarks like the MSCI EAFE or FTSE All-World ex-US. They don’t try to beat the market—they just let you ride it.

Some people worry about currency risk or political instability. Those are real concerns, but they’re already priced in. Over time, the market adjusts. What matters more is staying invested. The best international investors aren’t the ones who predict crises—they’re the ones who stay in through them.

What you’ll find below are real, tested approaches to using international index funds in your portfolio. You’ll see how top investors use them alongside U.S. ETFs, which funds have the lowest fees, and why some so-called "global" funds are actually just U.S. stocks in disguise. There’s no fluff. Just clear, practical info to help you build a portfolio that works no matter where the world’s economy goes next.

International Index Funds: Developed vs Emerging Markets Weight Allocation Explained

Understand how to allocate between developed and emerging markets in international index funds. Learn the optimal weights, key ETFs, risks, and how to avoid common mistakes in 2025.

View More