Hope Bias: Why Optimism Is Costing You Money and How to Fix It

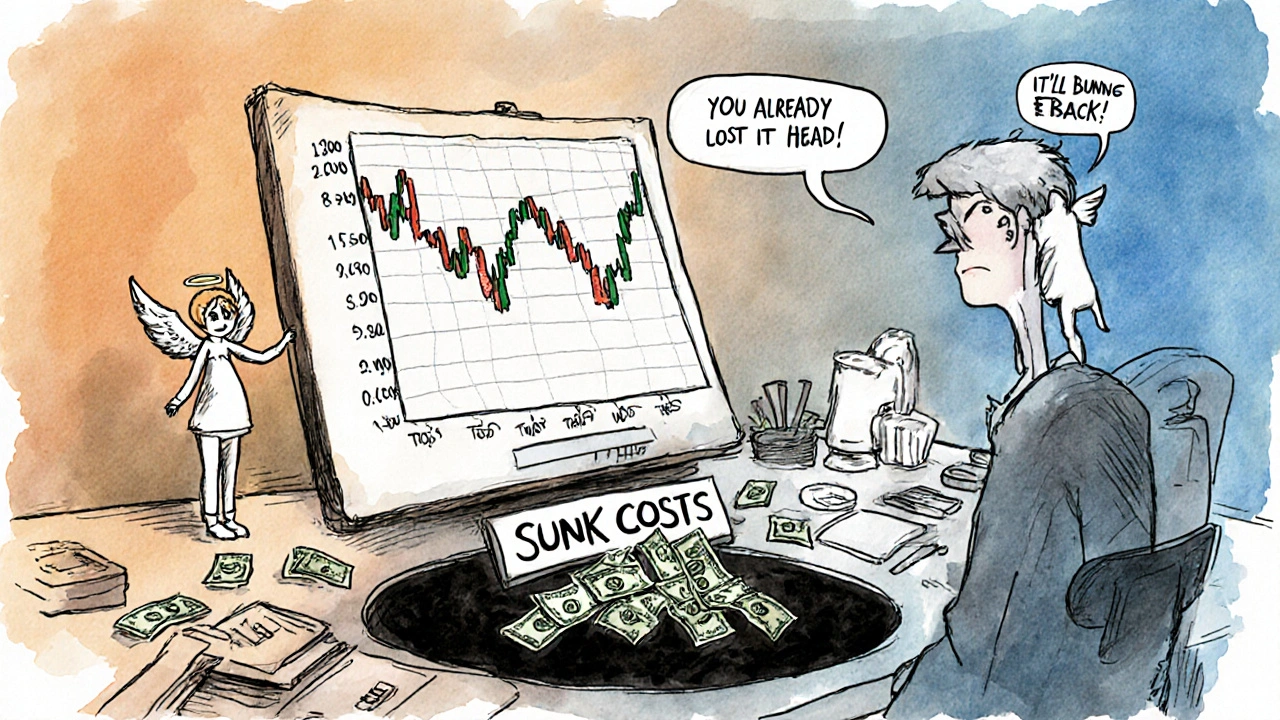

When you refuse to sell a stock that’s dropped 40% because you know it’ll bounce back, you’re not being patient—you’re falling for hope bias, the tendency to believe things will improve simply because you want them to. Also known as the disposition effect, it’s one of the most common—and expensive—mistakes investors make. This isn’t about being optimistic. It’s about ignoring data, clinging to emotional attachments, and pretending losses aren’t real until they’re much, much worse.

Hope bias doesn’t live alone. It teams up with loss aversion, the fear of realizing a loss more than the joy of making a gain, which makes you hold onto losers longer than you should. It feeds off overconfidence bias, the belief that you can time the market or pick winners better than professionals, which tricks you into thinking you’re the exception. And it’s fueled by mental accounting, the habit of treating money differently based on where it came from or what it’s for, like labeling a stock as "my retirement pick" so you can’t bear to sell it, even if it’s tanking.

You see this everywhere. People keep holding crypto that’s down 80% because they "believe in the future." They refuse to close a losing trade because they "just need one more day." They stick with a robo-advisor that’s underperforming for years because they "have faith in the algorithm." None of that works. Markets don’t care what you believe. They respond to price, volume, and fundamentals—not hope.

What’s worse? Hope bias makes you ignore better options. While you’re waiting for your losing stock to recover, you’re missing chances to rebalance, tax-loss harvest, or move into assets that are actually growing. The data doesn’t lie: investors who cut losses early and reinvest consistently outperform those who hold on for a miracle by up to 3% annually over 10 years. That’s not a small edge—that’s tens of thousands in extra wealth.

The fix isn’t cold-hearted. It’s simple. Set rules before you buy. Decide your exit point: 10% loss? 15%? Write it down. Use automation to enforce it. Let your robo-advisor handle tax-loss harvesting automatically. Stop checking your portfolio every day. Let data—not emotion—drive your decisions. You don’t need to be a genius to beat the market. You just need to stop believing the story you’re telling yourself.

Below, you’ll find real guides that show you exactly how to spot these biases in your own behavior, how to build systems that protect you from them, and which tools and platforms actually help you stay disciplined. No fluff. No theory. Just what works—for real investors, in real markets, right now.

Why You Keep Holding Losing Investments: Hope Bias and Sunk Costs Explained

Why do investors hold losing stocks too long? It's not about the market-it's about hope bias and the sunk cost fallacy. Learn how your brain tricks you and what to do instead.

View More