Holding Losers Too Long: Why You Keep Losing Money and How to Stop

When you holding losers too long, the habit of refusing to sell investments that have dropped in value, often due to emotional attachment or denial. Also known as the disposition effect, it’s one of the most common—and costly—mistakes in personal investing. You bought a stock at $50. It’s now at $30. You tell yourself, "I’ll wait until it gets back to break-even." But here’s the truth: the price you paid doesn’t matter anymore. Only what it’s worth today—and what it might do tomorrow—does.

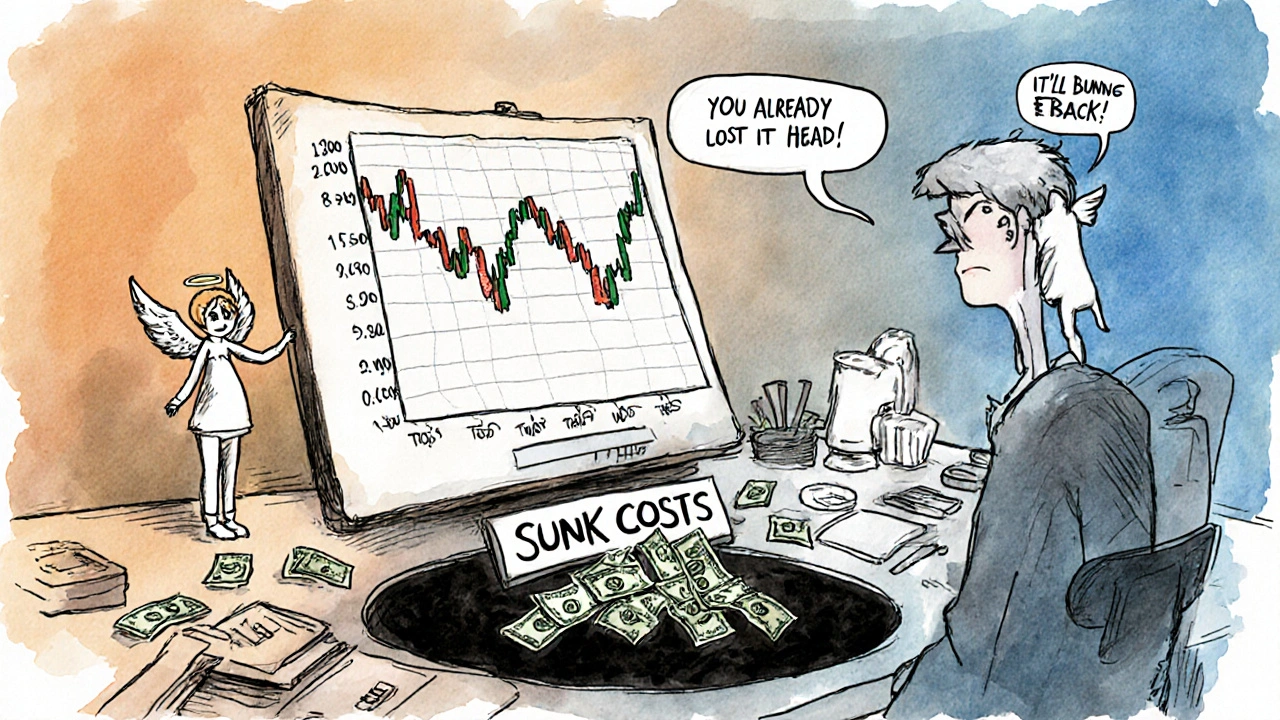

This isn’t about bad luck. It’s about loss aversion, a psychological bias where the pain of losing feels twice as strong as the pleasure of gaining. Studies from behavioral finance show people cling to losing positions not because they think they’ll rebound, but because selling means admitting they were wrong. That sting? It’s worse than the actual dollar loss. Meanwhile, you’re tying up capital that could be working for you elsewhere. You’re also ignoring signals: a stock falling hard often means the company’s fundamentals changed, not just the market swung.

And it’s not just stocks. You see it in crypto, ETFs, even real estate crowdfunding. Someone buys a token at $200. It drops to $40. They hold for two years, hoping for a miracle. Meanwhile, their portfolio is stuck in a dead end while the market moves on. emotional investing, making financial decisions based on fear, hope, or pride instead of data and strategy is the real enemy. It’s why people sell winners too early and hold losers too long—both hurt returns.

What’s the fix? Start by separating your identity from your trades. Your worth isn’t tied to whether a stock goes up or down. Set rules before you buy: "I’ll sell if it drops 20% and the reason I bought it no longer holds." Use tax-loss harvesting to turn losses into savings. And track your decisions—not just your portfolio balance. Over time, you’ll spot patterns: Do you always hold tech stocks too long after a crash? Do you panic-sell during news headlines? Write it down. Awareness breaks the cycle.

You don’t need to be a genius to beat this. You just need to be honest. The market doesn’t care if you’re right about a stock’s future. It only cares if you’re right about your actions today. The posts below show you exactly how top investors avoid this trap—using real data, simple rules, and tools that work in 2025. No fluff. No theory. Just what actually changes your results.

Why You Keep Holding Losing Investments: Hope Bias and Sunk Costs Explained

Why do investors hold losing stocks too long? It's not about the market-it's about hope bias and the sunk cost fallacy. Learn how your brain tricks you and what to do instead.

View More