ETF Weights Explained: How Holdings Shape Your Portfolio

When you buy an ETF weight, the percentage of a specific stock or asset inside an exchange-traded fund. Also known as fund weighting, it tells you exactly how much of your money is tied to each holding. It’s not just a number—it’s the hidden blueprint of your portfolio. If you think you’re diversified because you own an S&P 500 ETF, but 30% of it is in just five tech giants, you’re not diversified at all. You’re just betting big on a few companies dressed up as broad exposure.

ETF weights aren’t random. They’re calculated using different methods—market cap, equal weight, or even fundamental factors like dividends or earnings. Most popular ETFs, like SPY or VOO, use market-cap weighting, where bigger companies get more weight based on their total stock value. That means Apple, Microsoft, and Nvidia can dominate your returns, for better or worse. But there are alternatives. Equal-weight ETFs, like RSP, give every stock in the index the same share, no matter how big or small the company. That changes everything. You get more exposure to mid- and small-cap stocks, which often outperform over time—but with more volatility.

Why does this matter to you? Because ETF weights control your risk. If you don’t know what’s driving your returns, you can’t predict what happens when the market shifts. A tech-heavy ETF might crush the market in a bull run, but crush you when interest rates rise. And if you’re chasing ESG or sector-specific ETFs, their weights can be even more concentrated—like a fund that puts 20% into one renewable energy company. That’s not diversification. That’s a single stock with an ETF label.

Look at the top 10 holdings of any ETF you own. If you see the same names repeating across different funds, you’re probably overexposed. And if you’re using a robo-advisor, they might be stacking you with ETFs that all weight the same few stocks. That’s not a portfolio—it’s a cluster. Real portfolio strategy means understanding how each ETF’s weight structure affects your overall exposure. It’s not about how many funds you own. It’s about what’s inside them.

Some ETFs even use smart beta or factor-based weighting—focusing on value, momentum, or low volatility. These aren’t gimmicks. They’re deliberate ways to tilt your portfolio toward certain outcomes. But they come with trade-offs. Higher turnover, higher fees, and sometimes worse performance in certain markets. You need to know what you’re signing up for.

Below, you’ll find real breakdowns of how ETF weights actually play out in practice—from how they impact your tax bill to why some funds outperform others even when they track the same index. No theory. No fluff. Just what you need to see behind the curtain.

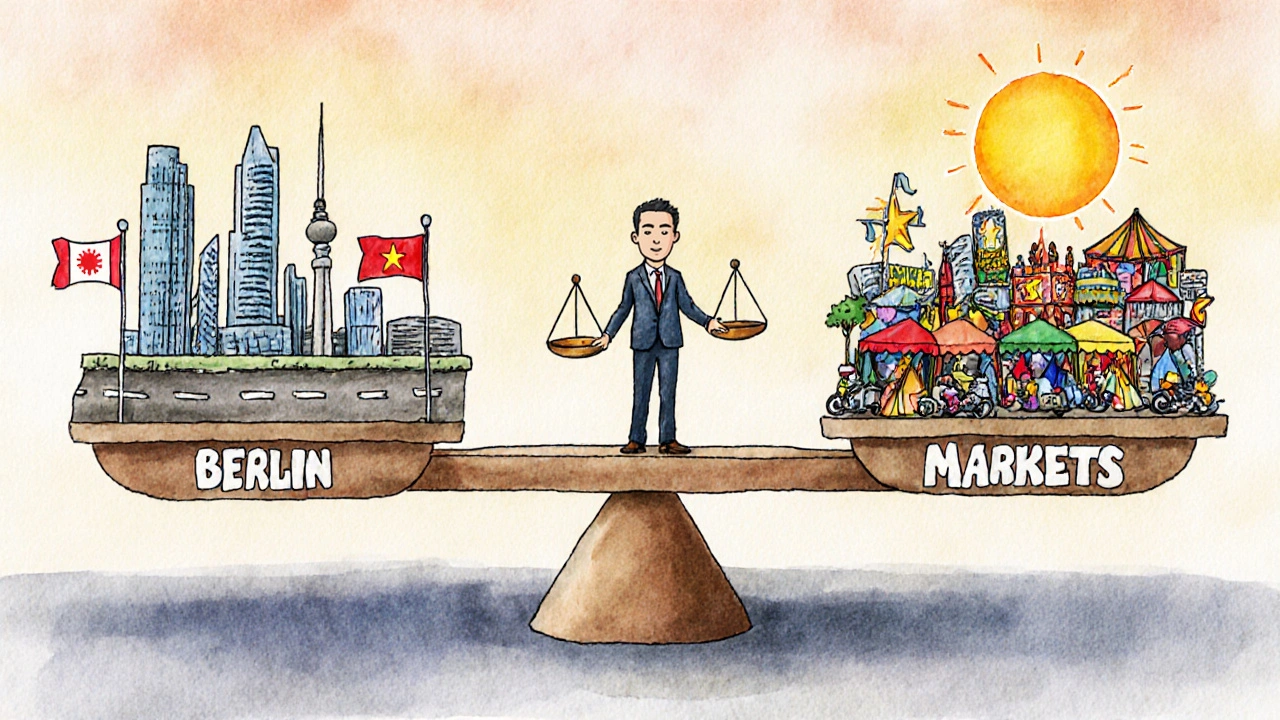

International Index Funds: Developed vs Emerging Markets Weight Allocation Explained

Understand how to allocate between developed and emerging markets in international index funds. Learn the optimal weights, key ETFs, risks, and how to avoid common mistakes in 2025.

View More