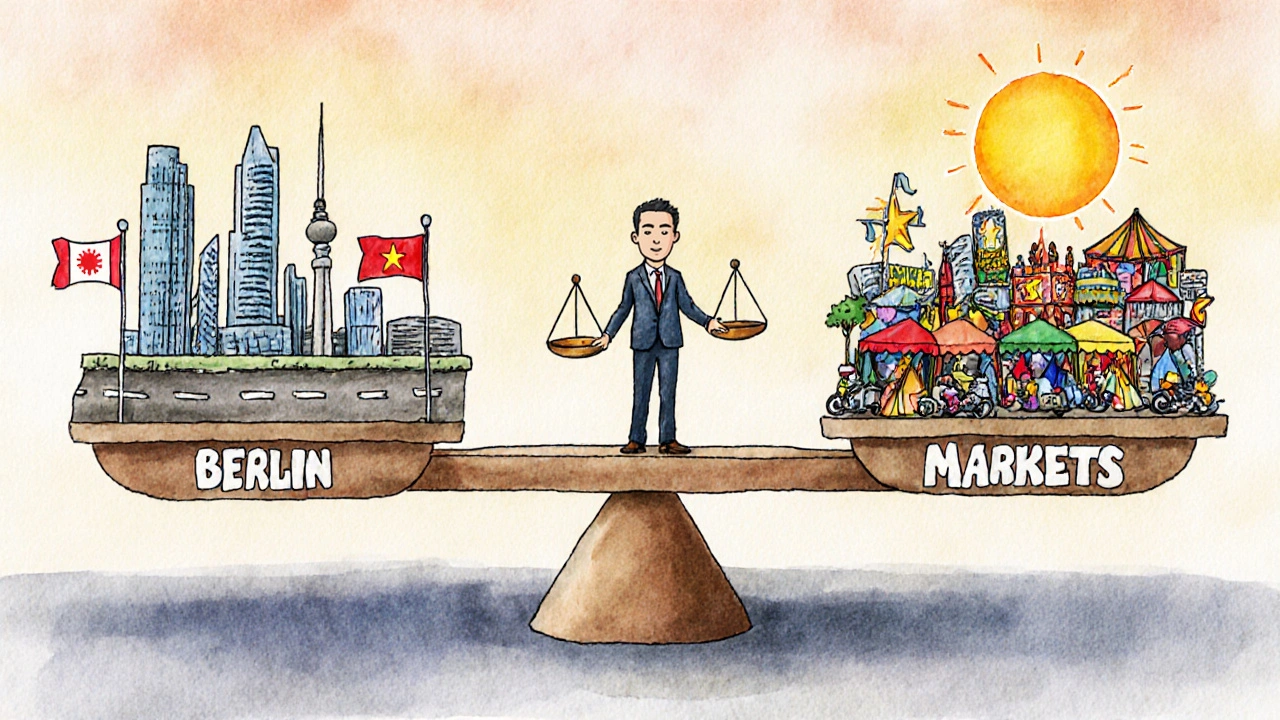

Emerging Markets: Where Growth, Risk, and Opportunity Collide

When we talk about emerging markets, nations with rapidly growing economies and expanding middle classes, often in Asia, Latin America, and Africa. Also known as developing economies, they're not just distant headlines—they're where the next wave of global wealth is being built. These aren't the same countries they were 20 years ago. India’s digital payments boom, Vietnam’s manufacturing surge, and Nigeria’s fintech explosion are real, measurable shifts—not projections.

But here’s the catch: currency risk, the chance that exchange rate swings will wipe out your returns isn’t just a footnote. If you buy an ETF, a basket of stocks or bonds traded like a single stock, often used to access emerging markets without picking individual companies focused on Brazil and the real drops 15% in a month, your gains vanish—even if the companies themselves are doing fine. That’s why smart investors don’t just chase growth. They look at political stability, local debt levels, and how much foreign capital is flowing in. And they use ETFs not as a bet on a country, but as a diversified tool to spread exposure.

Most people think emerging markets are all about high returns. But the real edge? Knowing when to hold back. When the U.S. dollar surges, money pulls out of these markets fast. When inflation spikes in Turkey or Argentina, local bonds can crater. That’s why you’ll find posts here that break down how to spot the quiet signals—like rising foreign reserves or falling current account deficits—that tell you when it’s safer to step in. You won’t find fluff about "the next China." You’ll find real data on which markets are actually improving their rules, lowering corruption, and building real infrastructure.

There’s no magic formula. But there are patterns. The best investors in emerging markets don’t guess. They track. They compare. They wait. And when the moment’s right, they act—with clear rules, not emotions. Below, you’ll find guides that show you exactly how to do that: which ETFs make sense today, how to handle currency swings without a finance degree, and why some markets are becoming safer bets than others. No hype. Just what works.

International Index Funds: Developed vs Emerging Markets Weight Allocation Explained

Understand how to allocate between developed and emerging markets in international index funds. Learn the optimal weights, key ETFs, risks, and how to avoid common mistakes in 2025.

View More