Developed Markets: What They Are and Why They Matter for Your Portfolio

When you hear developed markets, high-income economies with mature financial systems, strong institutions, and stable political environments. Also known as advanced markets, they include countries like the U.S., Japan, Germany, Canada, and Australia—places where markets have been around for decades, regulations are clear, and liquidity is high. These aren’t just fancy terms for rich countries. They’re the backbone of most diversified portfolios, especially for investors who want steady growth without constant turbulence.

Developed markets encompass the bulk of global stock market value, making up over 60% of the world’s equity capitalization. They’re where most ETFs, exchange-traded funds that track broad market indexes like the S&P 500 or MSCI World are built. You don’t need to pick individual stocks to get exposure—you just buy one fund that holds hundreds of companies across these economies. That’s why they’re the go-to for beginners and pros alike. But they’re not just about safety. In times of global uncertainty, money flows into developed markets because they’re predictable. When inflation spikes or geopolitics get messy, investors run to the U.S. dollar, German bonds, or Japanese yen—not because they’re exciting, but because they’re reliable.

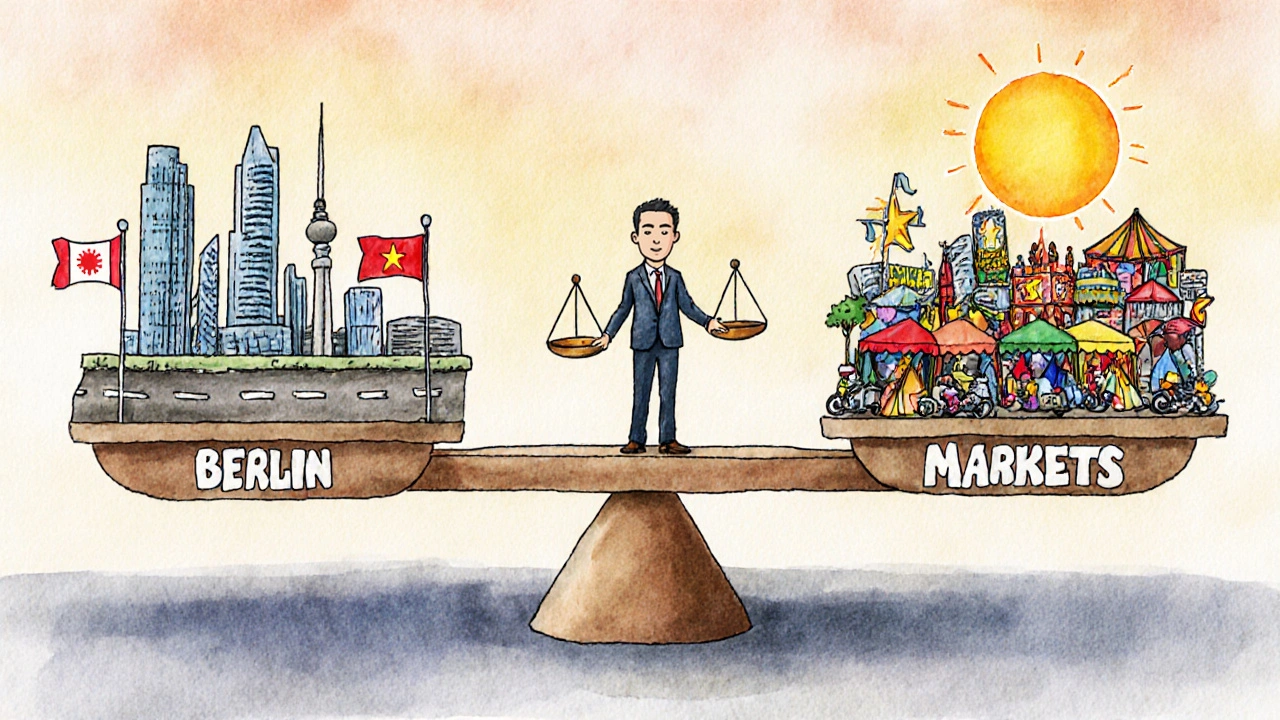

Still, developed markets aren’t the whole story. They relate to emerging markets, faster-growing but riskier economies like India, Brazil, or Vietnam, and the best portfolios balance both. You don’t chase growth in emerging markets by ignoring developed ones—you use the stability of developed markets to anchor your risk. Think of it like a car: developed markets are the tires and brakes; emerging markets are the engine. You need both to move forward without crashing.

What you’ll find in these posts isn’t theory. It’s real strategies used by tech-savvy women who invest online. You’ll see how developed markets fit into robo-advisor portfolios, how bond ladders work in low-volatility economies, and why tax-loss harvesting works better when you’re invested in stable, transparent markets. There’s no hype here—just clear, data-backed ways to use these markets to build wealth without stress.

International Index Funds: Developed vs Emerging Markets Weight Allocation Explained

Understand how to allocate between developed and emerging markets in international index funds. Learn the optimal weights, key ETFs, risks, and how to avoid common mistakes in 2025.

View More