Behavioral Finance: Why You Make Money Mistakes and How to Fix Them

When you sell a stock just because it dropped 5%, or buy a crypto because everyone on Twitter is hyping it, you’re not being irrational—you’re being human. That’s where behavioral finance, the study of how emotions and mental shortcuts shape financial decisions. Also known as psychological economics, it explains why smart people make dumb money moves—even when they know better. This isn’t about greed or laziness. It’s about hardwired brain patterns that turn investing into a battlefield between logic and instinct.

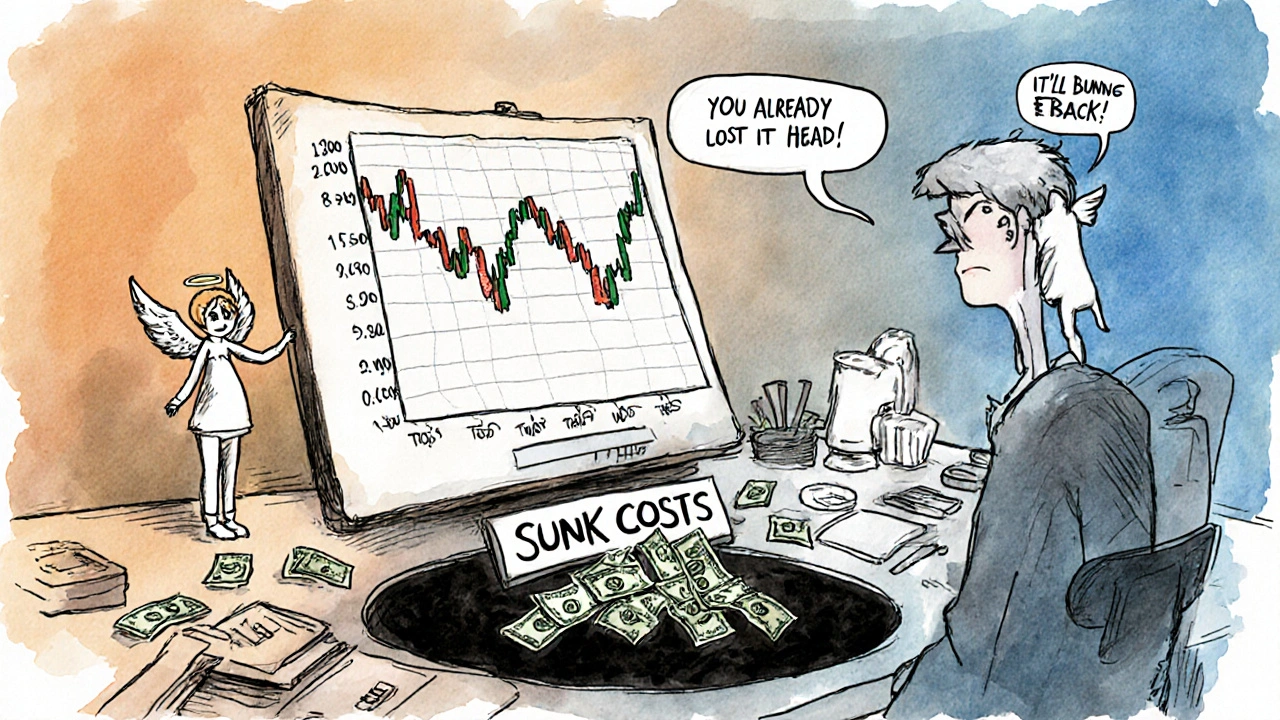

One of the biggest enemies in loss aversion, the tendency to feel the pain of a loss twice as strongly as the joy of an equal gain keeps you holding onto losing stocks too long, hoping they’ll bounce back. Meanwhile, overconfidence bias, the belief that you can time the market or pick winning stocks better than professionals leads you to trade too much, eat up fees, and miss compound growth. Then there’s mental accounting, treating money differently based on where it comes from or what it’s for—like treating a tax refund as "free money" to spend, but ignoring the same amount in your savings account. And let’s not forget herd behavior, following the crowd even when the data says to do the opposite, which is how bubbles form and panic sells happen.

These aren’t abstract ideas. They’re the reason people buy high and sell low. They’re why you ignore your own investment plan after a bad quarter. And they’re exactly what the posts below unpack—not with theory, but with real fixes. You’ll find clear steps to catch your own biases before they cost you, tools to automate decisions so your emotions don’t drive your portfolio, and real examples from investors who turned their psychology into an edge. No jargon. No fluff. Just what actually works when the market gets messy.

Why You Keep Holding Losing Investments: Hope Bias and Sunk Costs Explained

Why do investors hold losing stocks too long? It's not about the market-it's about hope bias and the sunk cost fallacy. Learn how your brain tricks you and what to do instead.

View More