2025/09 Investing Guides for Tech-Savvy Women

When you’re building wealth online, online investing, the practice of buying and managing investments through digital platforms without a traditional financial advisor. Also known as self-directed investing, it’s not about picking stocks like a Wall Street trader—it’s about using smart tools, cutting fees, and staying consistent from your couch. This month’s collection focuses on what actually works for women who are already comfortable with tech but want to make their money work harder—without the jargon or the fluff.

ETFs, exchange-traded funds that bundle dozens or hundreds of stocks into one easy-to-buy asset. Also known as basket investments, they’re the go-to for beginners and pros alike because they spread risk and cost less than mutual funds. You don’t need to pick Apple or Tesla alone—you can buy exposure to the whole tech sector, clean energy, or global markets with one click. Then there’s robo-advisors, automated platforms that build and manage your portfolio based on your goals and risk level. Also known as digital financial assistants, they handle rebalancing, tax-loss harvesting, and fee optimization while you sleep. These aren’t just for people who hate spreadsheets—they’re for anyone who wants to set it and forget it, without paying 1% a year in fees.

And if you’ve wondered whether crypto basics, the foundational knowledge needed to understand Bitcoin, Ethereum, and blockchain without falling for scams. Also known as cryptocurrency literacy, it’s not about moonshots or memes—it’s about knowing what’s real, what’s risky, and how to store it safely. This month’s posts break down wallets, exchanges, and security habits in plain language. You’ll also find real comparisons of platforms like Coinbase vs. Kraken vs. Gemini, with actual fee numbers, not marketing hype.

Behind all of this is one thing: portfolio strategy. It’s not about chasing trends. It’s about knowing how much to put in ETFs, how much to keep in cash, whether crypto belongs in your long-term plan, and when to adjust. The guides from September 2025 show you how to build a portfolio that fits your life—not someone else’s. Whether you’re just starting or already have $50K invested, you’ll find actionable steps that match your pace.

What you’ll find below aren’t theory-heavy essays. These are real walkthroughs: how one woman automated her investing in 30 minutes, how another cut her brokerage fees by 70%, and how a beginner avoided the biggest crypto mistake most new investors make. No fluff. No sales pitches. Just what works.

Emergency Fund Rules of Thumb: How Much You Really Need to Save

Learn how much you really need in an emergency fund-3 months, 6 months, or more-based on your income, expenses, and lifestyle. Practical, real-world advice for building savings without overwhelm.

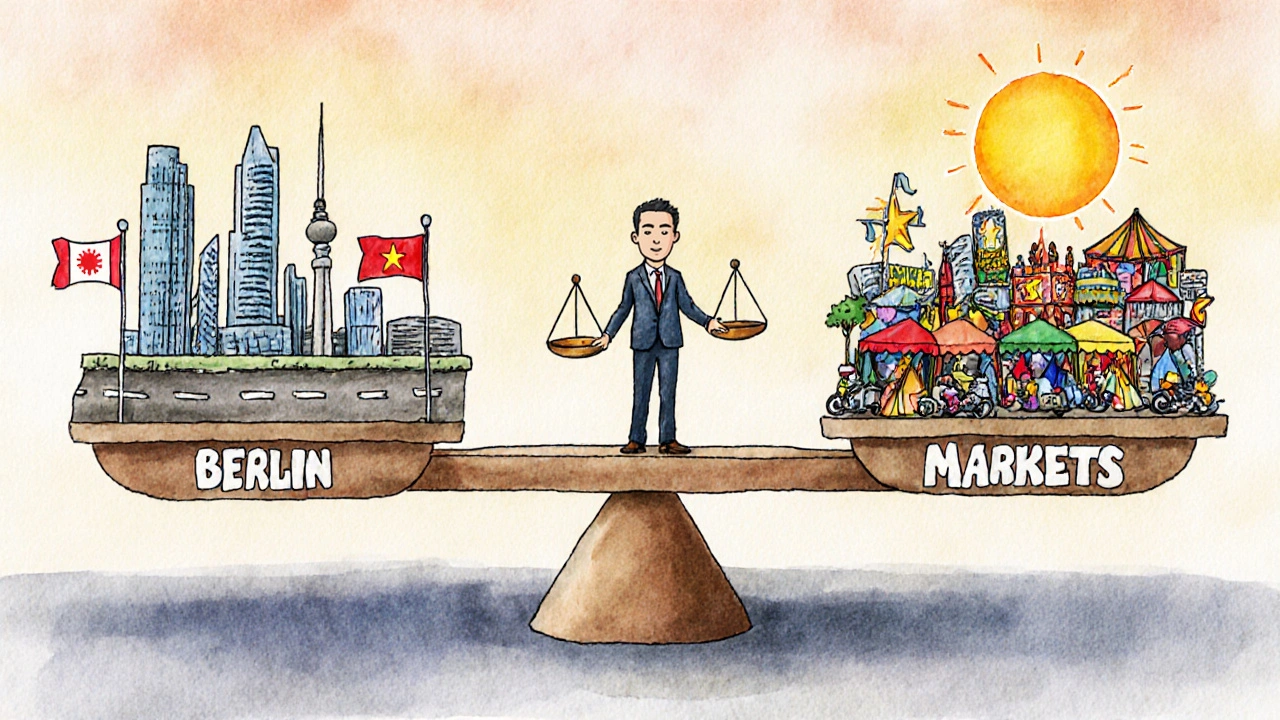

View MoreInternational Index Funds: Developed vs Emerging Markets Weight Allocation Explained

Understand how to allocate between developed and emerging markets in international index funds. Learn the optimal weights, key ETFs, risks, and how to avoid common mistakes in 2025.

View MoreClient Money Rules: Reconciliation and Audit Explained for Financial Firms

Client money rules require financial firms to segregate, reconcile daily, and audit client funds to protect assets. Learn how UK's CASS 7 and Australia's ASIC rules work, why firms fail, and how automation is changing compliance.

View More