Geek to Wealth: Fintech, Investing, and Personal Finance for Tech-Savvy Women

At the heart of this site is fintech, technology-driven financial services that make investing and banking simpler, faster, and more accessible. Also known as financial technology, it’s what powers the apps you use to invest, save, and track your money without a bank branch in sight. You’ll find clear breakdowns of how robo-advisors, automated platforms that build and manage diversified portfolios based on your goals actually work—no fluff, no hype. Whether you’re comparing tax-loss harvesting rules at Betterment or deciding if SoFi’s all-in-one app fits your life, these tools are designed for real people, not Wall Street insiders.

And it’s not just about investing. Your emergency fund, the cash buffer that stops a surprise bill from derailing your financial progress needs more than a vague rule of thumb. We show you how to calculate exactly how much you need based on your income, bills, and risks. From bond ladders that steady your income to behavioral biases that cost you money, every post here cuts through the noise and gives you something you can use tomorrow.

What you’ll find below isn’t a random list of articles—it’s a toolkit. Whether you’re just starting out or fine-tuning your portfolio, you’ll walk away with actionable steps, not theory.

QR Code Payments: How Mobile Payments Are Evolving

QR code payments are transforming how money moves globally, offering low-cost, accessible transactions for consumers and small businesses. From India's UPI to PayPal's integration in the U.S., this technology is replacing cards in informal economies and beyond.

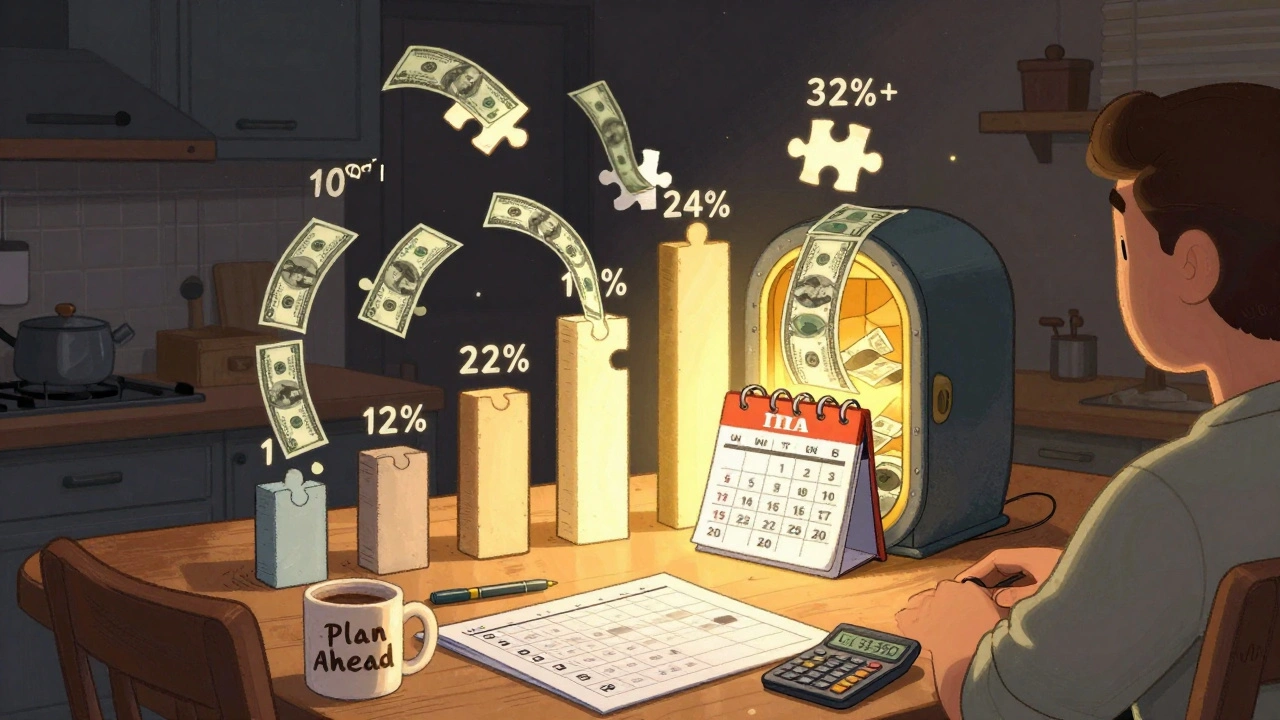

View MoreTax Bracket Management: How to Fill Lower Brackets with Roth Conversions to Save Thousands

Learn how to use Roth IRA conversions to fill lower tax brackets and reduce your lifetime tax bill. This guide shows exactly when, how much, and why to convert-based on 2025 tax rules and real-world examples.

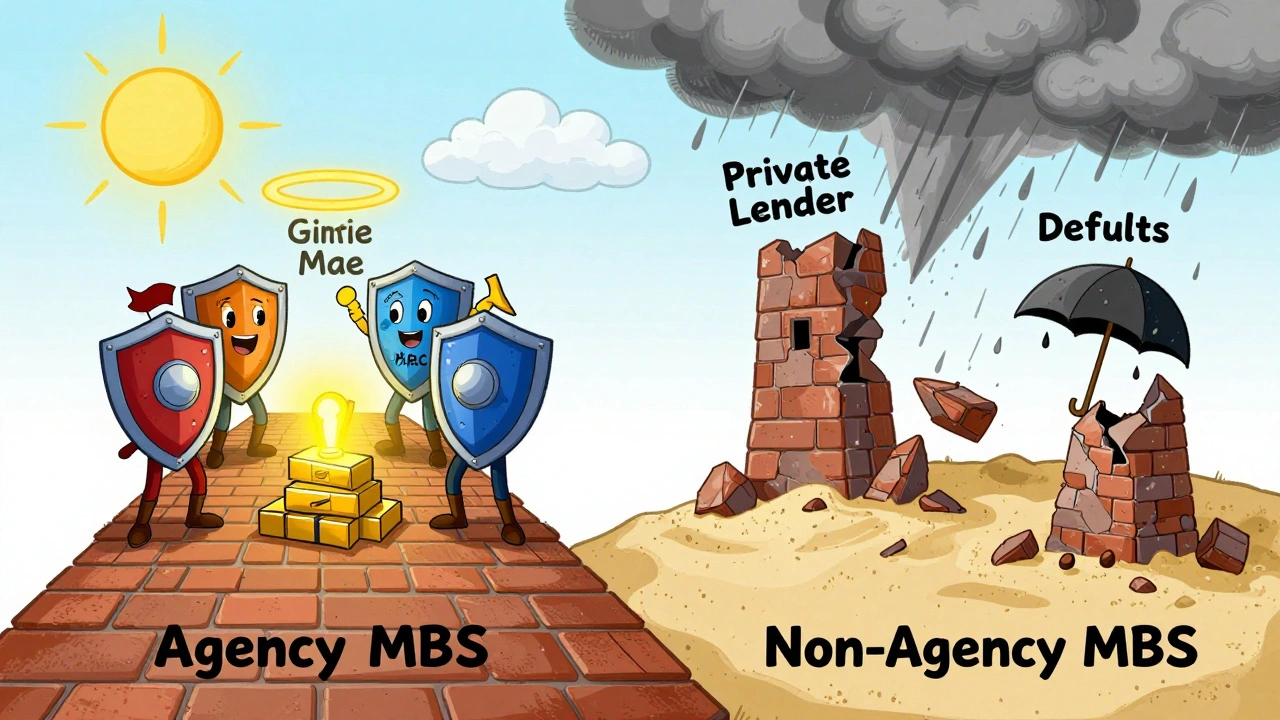

View MoreAgency MBS vs Non-Agency MBS: Understanding Credit Backing Differences

Understand the critical difference between agency and non-agency MBS: one has government backing, the other doesn't. Learn how credit risk, yields, liquidity, and structure impact your fixed-income investments.

View MoreOpen Finance vs. Open Banking: How the Scope Is Expanding

Open banking lets you share bank account data with apps; open finance expands that to investments, loans, crypto, and insurance. Learn how the scope is growing-and why it matters for your money.

View MoreSecondary Offerings and How They Move Stock Prices

Secondary offerings can boost a company’s cash or dilute your ownership. Learn how dilutive and non-dilutive offerings impact stock prices, what to watch for, and how to tell if it’s a sign of strength or weakness.

View MoreTax-Loss Harvesting While Rebalancing: How to Coordinate Moves for Better After-Tax Returns

Tax-loss harvesting while rebalancing lets you cut your tax bill while fixing your portfolio’s allocation. Learn how to do it right, avoid wash-sale traps, and boost after-tax returns by up to 1% a year.

View MoreDollar-Cost Averaging with Paychecks: The Simple Set-and-Forget Way to Build Wealth

Dollar-cost averaging with paychecks is the simplest, most effective way to build long-term wealth without stress or timing the market. Automate your contributions and let compounding do the work.

View MoreStyle Diversification: How to Mix Value and Growth Investments for a Stronger Portfolio

Mixing value and growth investments reduces portfolio volatility and protects against market swings. Learn how to build a balanced portfolio using ETFs and avoid common timing mistakes.

View MoreObservability for Payments: How Metrics, Logs, and Traces Keep Transactions Running

Payment observability uses metrics, logs, and traces to track transaction success, reduce failures, and meet compliance. Learn how top processors cut failures by 37% and why 100% trace coverage is non-negotiable.

View MoreStop-Loss Orders vs Mental Stops: Which One Protects Your Capital Better?

Learn the real difference between stop-loss orders and mental stops, how each affects your risk, and which one works best for your trading style. Discover expert-backed strategies to protect your capital without letting emotions take over.

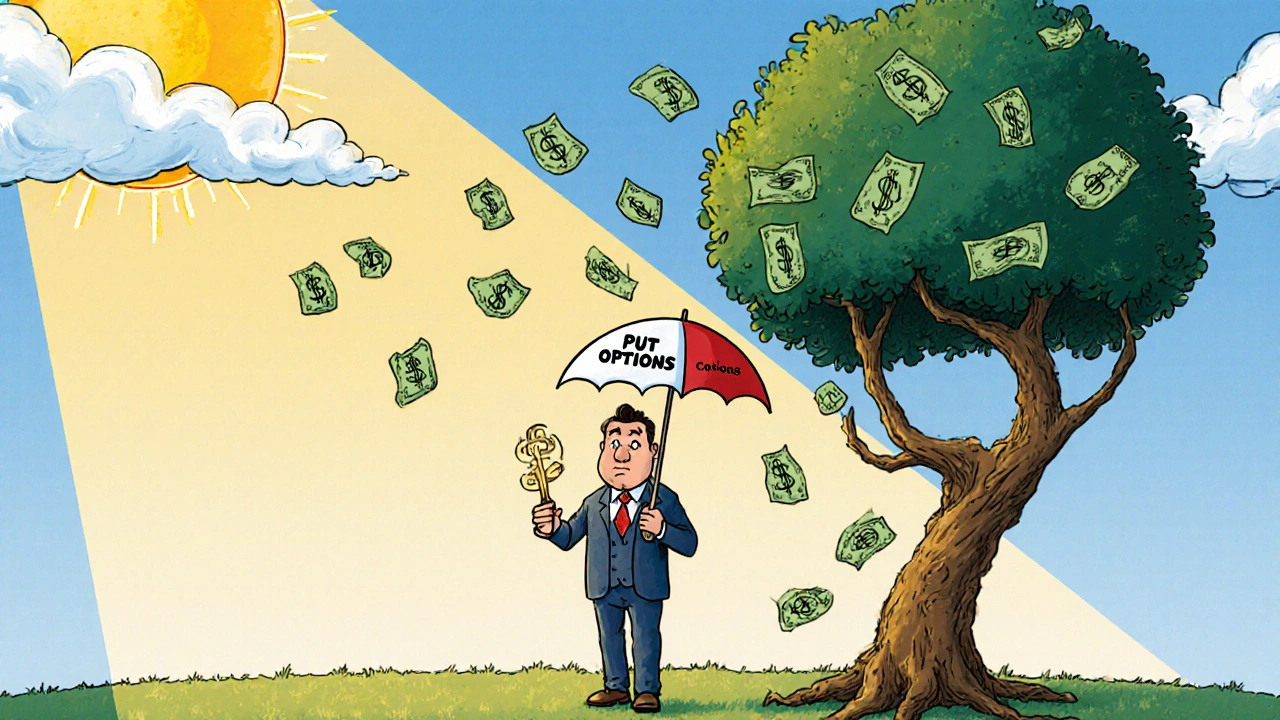

View MorePortfolio Hedging with Options: Protect Your Investments Using Puts, Collars, and Spreads

Learn how to protect your investment portfolio from market crashes using puts, collars, and spreads. Discover practical, real-world strategies that work in 2025 without selling your holdings.

View MoreFintech Marketing Strategies for Customer Acquisition: Proven Tactics That Work in 2025

Learn proven fintech customer acquisition strategies for 2025 that build trust, reduce costs, and convert users-backed by real data on referral programs, personalization, and compliance.

View More